Investors looking for potential growth in the metal sector often consider Rajnandini Metal as an interesting option. The company’s steady performance and expansion plans make it a stock to watch. Many factors, such as global metal demand, market trends, and business strategies, play a role in determining its future share price. Rajnandini Metal Share Price on 25 March 2025 is 4.44 INR. This article will provide more details on Rajnandini Metal Share Price Target 2025, 2026 to 2030.

Rajnandini Metal Company Info

- Founded: 2010

- Headquarters: India

- Number of employees: 206 (2024)

Rajnandini Metal Share Price Chart

Rajnandini Metal Share Price Details

- Today Open: 4.41

- Today High: 4.59

- Today Low: 4.41

- Mkt cap: 122.76Cr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 14.90

- 52-wk low: 4.40

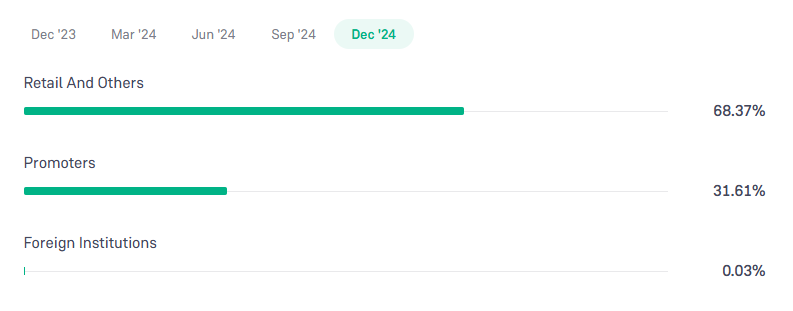

Rajnandini Metal Shareholding Pattern

- Promoters: 31.61%

- Foreign Institutions: 0.03%

- Mutual Funds: 0%

- Retails and others: 68.37%

- Domestic Institutions: 0%

Rajnandini Metal Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹15

- 2026 – ₹20

- 2027 – ₹25

- 2028 – ₹30

- 2029 – ₹35

- 2030 – ₹40

Rajnandini Metal Share Price Target 2025

Rajnandini Metal share price target 2025 Expected target could be ₹15. Here are five key factors affecting the growth of Rajnandini Metal Share Price Target 2025:

-

Demand for Metals – The company’s growth depends on the rising demand for copper and other metals in industries like electrical, automotive, and infrastructure.

-

Raw Material Prices – Fluctuations in raw material costs, including copper and aluminum, can impact profitability and influence share prices.

-

Expansion and Capacity Growth – Any new projects, production expansions, or technological advancements can drive higher revenue and boost investor confidence.

-

Government Policies and Regulations – Supportive policies for the metal industry, such as import-export regulations and subsidies, can play a crucial role in the company’s growth.

-

Global Market Trends – Economic conditions, international trade relations, and commodity price trends will directly affect the company’s performance and stock movement.

Rajnandini Metal Share Price Target 2030

Rajnandini Metal share price target 2030 Expected target could be ₹40. Here are five key factors affecting the growth of Rajnandini Metal Share Price Target 2030:

-

Long-Term Demand for Metals – Increasing use of copper, aluminum, and other metals in renewable energy, electric vehicles, and infrastructure projects can drive sustained growth.

-

Technological Advancements – Adoption of advanced manufacturing processes and recycling technologies can improve efficiency, reduce costs, and enhance profitability.

-

Global Commodity Market Trends – The company’s performance will depend on global metal prices, trade policies, and demand-supply dynamics in the international market.

-

Sustainability and ESG Initiatives – Companies that align with environmental, social, and governance (ESG) standards may attract more investors and long-term stakeholders.

-

Expansion and Diversification – Rajnandini Metal’s ability to expand its product portfolio, enter new markets, or form strategic partnerships will be key to its long-term growth potential.

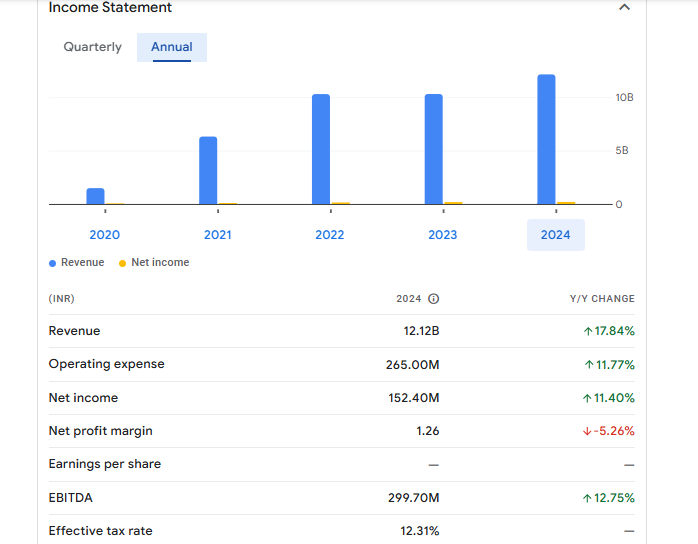

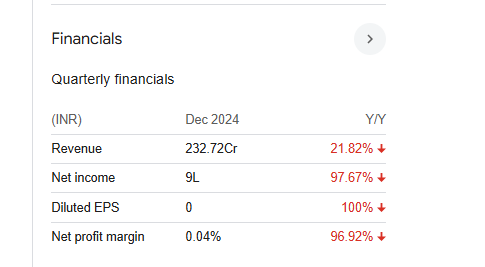

Financials Statement Of Rajnandini Metal

| (INR) | 2024 | Y/Y change |

| Revenue | 12.12B | 17.84% |

| Operating expense | 265.00M | 11.77% |

| Net income | 152.40M | 11.40% |

| Net profit margin | 1.26 | -5.26% |

| Earnings per share | — | — |

| EBITDA | 299.70M | 12.75% |

| Effective tax rate | 12.31% | — |

Read Also:- Adani Port Share Price Target Tomorrow 2025, 2026 To 2030