Australian shares saw a slight deepening of losses after the Reserve Bank of Australia (RBA) delivered its highly anticipated interest rate cut on Tuesday, marking the first such reduction in over four years. The decline in the market was largely driven by a sell-off in the country’s major financial stocks, which weighed heavily on the broader market performance.

The S&P/ASX 200 index had been trading 0.4% lower in anticipation of the RBA’s decision. Following the announcement, the index initially trimmed some of its losses, narrowing the drop to 0.3%. However, the index later reversed course and fell further, ultimately closing down by around 0.7%. As of the latest data, the index was down by 0.5%, reflecting the continued impact of the central bank’s decision on investor sentiment.

Australian shares saw a slight extension of their losses on Tuesday after the Reserve Bank of Australia (RBA) delivered its much-anticipated interest rate cut, marking the first reduction in over four years. The market reaction was largely driven by a sell-off in the country’s major financial stocks, which saw a decline due to their sensitivity to interest rate movements.

Before the RBA’s decision, the S&P/ASX 200 index was already trading 0.4% lower. Following the announcement, the index initially pared some of its losses, reducing the decline to 0.3%. However, the market then shifted direction, and the index eventually dropped by around 0.7%. It was last seen trading 0.5% lower, reflecting ongoing market concerns after the central bank’s move.

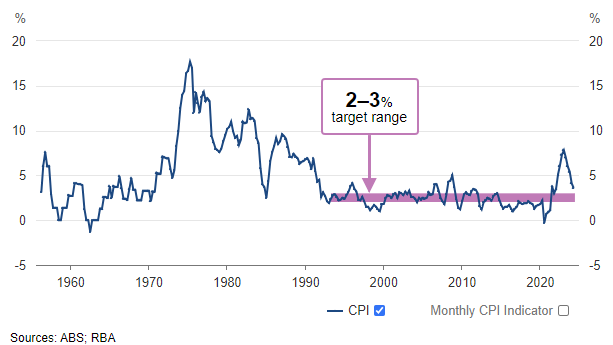

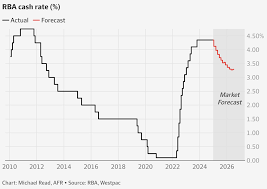

The RBA reduced its key interest rate by 25 basis points to 4.10%, marking the first easing of monetary policy since November 2020. The decision came as the bank acknowledged progress on inflation, but expressed caution over the broader economic outlook. The rate cut led to a sell-off in rate-sensitive financial stocks, particularly the major banks. These stocks had seen significant gains during the four-year period when borrowing costs remained elevated, and investors responded by selling off shares in the wake of the rate cut. The financial sector fell by around 1%, with Commonwealth Bank of Australia dropping 1%, while other major lenders saw their shares fall between 0.8% and 2.3%.

In response to the rate cut, all four of Australia’s largest banks—often referred to as the “Big Four”—reduced their home loan rates by 0.25%. This adjustment came as part of their standard response to changes in the RBA’s official cash rate, further influencing the market’s movements.

According to Grady Wulff, a market analyst at Bell Direct, sectors like financials have faced significant pressure as recent rate cuts negatively impact the earnings growth potential of Australia’s major banks. This is particularly concerning at a time when net interest margins—where banks generate a substantial portion of their profits—have likely reached their peak. With the reduction in rates, banks may see limited opportunities for growth in their earnings from lending activities, adding to the challenges in the financial sector.

Meanwhile, the mining sector also faced a decline, with stocks falling by 0.4%. This drop was primarily driven by the world’s largest-listed miner, BHP, which reported a 23% fall in its interim profit to $5.08 billion. The results marked the lowest profit for the company since 2019. In addition to the weaker-than-expected earnings, BHP raised concerns over potential growth risks stemming from the escalating U.S.-China trade tensions, which could impact demand for commodities and add uncertainty to the global economic outlook.

Rival mining company Rio Tinto also saw a slight decline, shedding 0.3% ahead of its upcoming earnings report later this week. This drop further contributed to the overall pressure on the mining sector, which was already under strain due to the disappointing results from BHP.

In neighboring New Zealand, the benchmark S&P/NZX 50 index saw a 0.4% drop, closing at 13,016.88. The decline in the index came amid expectations that the Reserve Bank of New Zealand (RBNZ) will implement a further interest rate cut. The central bank is anticipated to reduce rates by 50 basis points during its meeting on Wednesday, a move that has been speculated to weigh on market sentiment in the short term.