RCF (Rashtriya Chemicals and Fertilizers) is a well-known name in India’s fertilizer industry, playing a key role in agricultural growth. Investors looking at RCF share price targets are keen to understand its future potential, driven by government support, demand for fertilizers, and company expansion plans. RCF Share Price on 21 March 2025 is 127.60 INR. This article will provide more details on RCF Share Price Target 2025, 2026 to 2030.

RCF Company Info

- Headquarters: Mumbai

- Number of employees: 2,526 (2024)

- Revenue: 12,812.17 crores INR (US$1.6 billion, 2021–2022)

- Subsidiaries: Rajasthan Rashtriya Chemicals & Fertilizers Ltd, RCF HM Construction Solutions Pvt Ltd

RCF Share Price Chart

RCF Share Price Details

- Today Open: 123.00

- Today High: 130.35

- Today Low: 122.78

- Mkt cap: 7.04KCr

- P/E ratio: 26.58

- Div yield: 0.97%

- 52-wk high: 245.00

- 52-wk low: 110.80

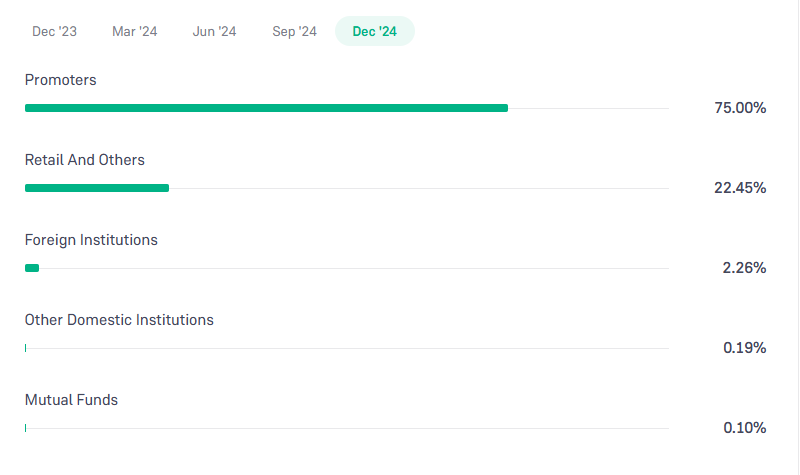

RCF Shareholding Pattern

- Promoters: 75%

- Foreign Institutions: 2.26%

- Mutual Funds: 0.10%

- Retails and others: 22.45%

- Domestic Institutions: 0.19%

RCF Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹245

- 2026 – ₹270

- 2027 – ₹300

- 2028 – ₹330

- 2029 – ₹360

- 2030 – ₹390

RCF Share Price Target 2025

RCF share price target 2025 Expected target could be ₹245. Here are 5 Key Factors Affecting Growth for RCF Share Price Target 2025:

-

Government Policies & Subsidies – Rashtriya Chemicals & Fertilizers (RCF) benefits from government support in the agriculture sector, including subsidies on fertilizers, which can boost revenue and profitability.

-

Raw Material Prices – The cost of key inputs like natural gas and phosphoric acid significantly impacts production costs. Stable or lower prices can improve margins, while volatility may pose challenges.

-

Agricultural Demand & Monsoon Impact – A good monsoon increases crop production, leading to higher demand for fertilizers, positively impacting RCF’s sales and profitability.

-

Expansion & Modernization – RCF’s investment in capacity expansion, new product development, and technology upgrades can drive future growth and enhance competitiveness.

-

Export Market Growth – Increasing international demand for fertilizers and chemicals provides RCF with opportunities to expand its global footprint and boost revenues.

RCF Share Price Target 2030

RCF share price target 2030 Expected target could be ₹390. Here are 5 Key Factors Affecting Growth for RCF Share Price Target 2030:

-

Long-Term Government Support – Continued government policies, subsidies, and reforms in the fertilizer sector will play a crucial role in RCF’s sustained growth over the decade.

-

Shift to Sustainable & Specialty Fertilizers – Increasing demand for eco-friendly and advanced fertilizers can open new revenue streams for RCF, encouraging innovation and expansion.

-

Technological Advancements & Automation – Adoption of modern manufacturing processes and digital transformation can enhance efficiency, reduce costs, and improve profit margins.

-

Global Market Expansion – Strengthening exports and establishing a strong presence in international markets will help RCF mitigate domestic market fluctuations and increase revenue.

-

Raw Material & Energy Costs – Stable and affordable supply of raw materials like natural gas and phosphoric acid will be essential for maintaining profitability and ensuring long-term business stability.

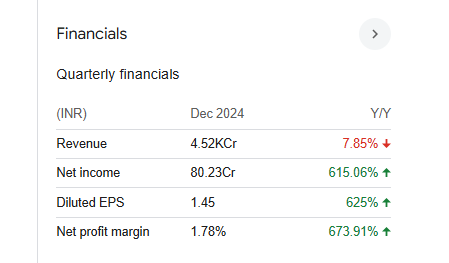

Financials Statement Of RCF

| (INR) | 2024 | Y/Y change |

| Revenue | 169.81B | -20.84% |

| Operating expense | 63.13B | -18.15% |

| Net income | 2.25B | -76.69% |

| Net profit margin | 1.33 | -70.44% |

| Earnings per share | — | — |

| EBITDA | 5.12B | -67.37% |

| Effective tax rate | 25.20% | — |

Read Also:- Biocon Share Price Target Tomorrow 2025, 2026 To 2030