Resourceful Automobile is a growing company in the two-wheeler automobile sector, mainly known for its Yamaha dealership under the name Sawhney Automobile. After its IPO in 2024, the stock gained a lot of attention due to strong investor interest. As the company plans to expand its showroom network and improve services in the Delhi-NCR region, many investors are hopeful about its future. The share price target of Resourceful Automobile will depend on how well it grows its business, manages its finances, and keeps up with changes in the automobile industry. Resourceful Automobile Share Price on 12 April 2025 is 50.00 INR. This article will provide more details on Resourceful Automobile Share Price Target 2025, 2026 to 2030.

Resourceful Automobile Company Info

- Headquarters: India

- Number of employees: 8 (2024).

Resourceful Automobile Share Price Chart

Resourceful Automobile Share Price Details

- Today Open: 50.00

- Today High: 50.00

- Today Low: 50.00

- Mkt cap: 13.28Cr

- P/E ratio: 16.19

- Div yield: N/A

- 52-wk high: 128.00

- 52-wk low: 46.29

Resourceful Automobile Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹130

- 2026 – ₹150

- 2027 – ₹170

- 2028 – ₹190

- 2029 – ₹210

- 2030 – ₹230

Resourceful Automobile Share Price Target 2025

Resourceful Automobile share price target 2025 Expected target could be ₹130. Here are five key factors that could influence the company’s share price growth by 2025:

-

Expansion of Showroom Network

The company plans to utilize IPO proceeds to open new showrooms in Delhi/NCR, aiming to increase its market presence and customer base. -

Dependence on Yamaha Dealership

A significant portion of revenue comes from its Yamaha dealership. Any changes in Yamaha’s performance or policies could directly impact Resourceful Automobile’s sales. -

Industry Volatility

The automotive sector faces rapid changes due to evolving technologies, economic conditions, and consumer preferences, which could affect demand for traditional vehicles. -

Financial Health and Debt Management

The company has outstanding unsecured loans. Effective debt management and financial planning are crucial for sustaining growth and investor confidence. -

Market Sentiment Post-IPO

Initial enthusiasm led to overvaluation concerns, with the stock experiencing a 25% drop from its listing price. Market perception and investor sentiment will play a role in future price movements.

Resourceful Automobile Share Price Target 2030

Resourceful Automobile share price target 2030 Expected target could be ₹230.

Here are several key factors could influence the company’s growth trajectory:

-

Expansion of Showroom Network

The company intends to utilize IPO proceeds to open new showrooms in Delhi/NCR, aiming to increase its market presence and customer base . -

Dependence on Yamaha Dealership

A significant portion of revenue comes from its Yamaha dealership. Any changes in Yamaha’s performance or policies could directly impact Resourceful Automobile’s sales . -

Industry Volatility and Technological Advancements

The automotive sector is undergoing rapid changes due to evolving technologies, economic conditions, and consumer preferences. The rise of electric vehicles and autonomous technologies could affect demand for traditional two-wheelers . -

Financial Health and Debt Management

Effective debt management and financial planning are crucial for sustaining growth and investor confidence. The company’s ability to manage its financial obligations will play a significant role in its long-term success . -

Market Sentiment and Regulatory Environment

Initial enthusiasm led to overvaluation concerns, with the stock experiencing a significant drop from its listing price. Market perception and investor sentiment, along with regulatory changes, will play a role in future price movements .

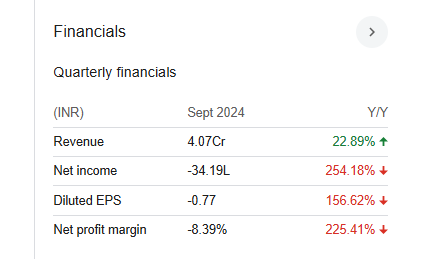

Financial Statement Of Resourceful Automobile

| (INR) | 2024 | Y/Y change |

| Revenue | 193.60M | -0.12% |

| Operating expense | 14.57M | -26.01% |

| Net income | 19.47M | 369.04% |

| Net profit margin | 8.83 | 312.62% |

| Earnings per share | — | — |

| EBITDA | 36.48M | 143.22% |

| Effective tax rate | 25.27% | — |

Read Also:- Indian Hotels Share Price Target 2025, 2026 To 2030