Reliance Industries Limited (RIL) is one of India’s largest and most trusted companies. From energy and petrochemicals to telecom and retail, RIL has created a strong presence in many sectors. Over the years, its share has shown steady growth, attracting the attention of both new and experienced investors. People have faith in RIL because of its strong leadership, innovative projects, and future-ready vision. RIL Share Price on 10 April 2025 is 1,187.50 INR. This article will provide more details on RIL Share Price Target 2025, 2026 to 2030.

RIL Company Info

- Founded: 1957, Maharashtra

- Founder: Dhirubhai Ambani

- Headquarters: Mumbai

- Number of employees: 3,47,362 (2024)

- Revenue: 10 lakh crores INR (2024)

- Subsidiaries: Reliance Retail, Jio-bp, Jio Platforms, Network18.

RIL Share Price Chart

RIL Share Price Details

- Today Open: 1,169.50

- Today High: 1,189.80

- Today Low: 1,168.00

- Mkt cap: 16.04LCr

- P/E ratio: 23.23

- Div yield: 0.42%

- 52-wk high: 1,608.80

- 52-wk low: 1,114.85

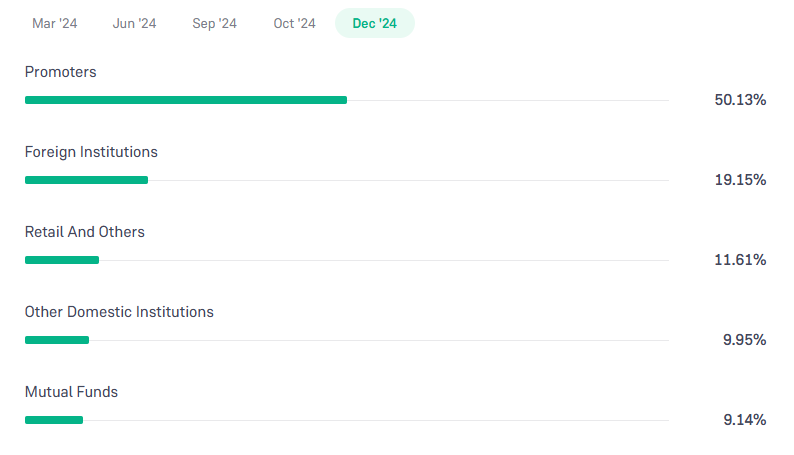

RIL Shareholding Pattern

- Promoters: 50.13%

- Foreign Institutions: 19.15%

- Mutual Funds: 9.14%

- Retails and others: 11.61%

- Domestic Institutions: 9.95%

RIL Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹1610

- 2026 – ₹1900

- 2027 – ₹2200

- 2028 – ₹2500

- 2029 – ₹2800

- 2030 – ₹3100

RIL Share Price Target 2025

RIL share price target 2025 Expected target could be ₹1610. Reliance Industries Limited (RIL) is poised for growth, with several key factors influencing its share price target for the year:

-

Telecom Sector Expansion

RIL’s telecom arm, Jio, is expected to be a significant earnings driver. Analysts anticipate a 12% increase in Average Revenue Per User (ARPU) and a 4-5% growth in subscriber base, contributing to overall revenue growth.

-

Retail Business Recovery

The retail segment is projected to return to double-digit EBITDA growth, reflecting a robust recovery and increased consumer spending. This resurgence is anticipated to bolster RIL’s consolidated earnings.

-

Energy Sector Performance

Improvements in refining margins are expected to enhance the profitability of RIL’s Oil-to-Chemicals (O2C) division. A rebound in Gross Refining Margins (GRM) is likely to positively impact the company’s financial performance.

-

New Energy Initiatives

RIL’s strategic investments in renewable energy, including the development of the Dhirubhai Ambani Green Energy Giga Complex, position the company to capitalize on the global shift towards sustainable energy. These initiatives are projected to contribute significantly to future earnings.

-

Potential Listing of Jio

The anticipated listing of Jio could unlock substantial value, serving as a re-rating catalyst for RIL’s stock and enhancing shareholder value.

RIL Share Price Target 2030

RIL share price target 2030 Expected target could be ₹3100. As of April 2025, Reliance Industries Limited (RIL) is strategically positioned for substantial growth leading up to 2030. Several key factors are expected to influence its share price trajectory:

-

Renewable Energy Initiatives

RIL has committed over ₹75,000 crore (approximately $10 billion) to develop its New Energy and New Materials business, aiming to achieve net-zero carbon emissions by 2035. This includes establishing 100 GW of renewable energy capacity and a solar photovoltaic giga factory in Jamnagar. These initiatives are projected to generate $10-15 billion in revenue by 2030, significantly enhancing RIL’s financial performance.

-

Digital Services Expansion

The company’s digital arm, Jio, is set to benefit from India’s digital economy, which is projected to grow sixfold to $1 trillion by 2030. With current average data usage at 28.7 GB per month and voice usage at 1,008 minutes per month, Jio’s expanding subscriber base and data consumption trends are poised to drive revenue growth.

-

Retail Market Growth

India’s retail market is anticipated to surpass $1.4 trillion by 2027, positioning RIL’s retail segment to capitalize on this expansion. The company’s extensive network and diversified product offerings are expected to strengthen its market presence and profitability.

-

Strategic Partnerships and Acquisitions

RIL’s recent collaborations, such as the partnership with SpaceX’s Starlink to introduce satellite internet services in India, and the acquisition of Paramount Global’s stake in Viacom18, enhance its technological capabilities and media presence. These strategic moves are likely to open new revenue streams and bolster market position.

-

Financial Performance and Market Valuation

Analysts forecast RIL’s earnings to grow by approximately 14% annually, with a potential 31% upside in stock price. The company’s Price-to-Earnings (P/E) ratio of 26.6x is below the Indian market average of 30.6x, indicating favorable market valuation and investor confidence.

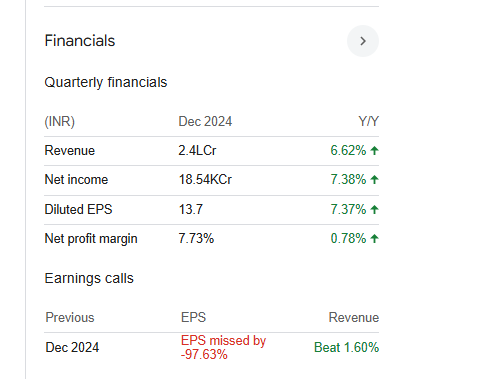

Financial Statement Of RIL

| (INR) | 2024 | Y/Y change |

| Revenue | 9.01T | 2.65% |

| Operating expense | 2.04T | 9.14% |

| Net income | 696.21B | 4.38% |

| Net profit margin | 7.73 | 1.71% |

| Earnings per share | 31.07 | -4.90% |

| EBITDA | 1.57T | 10.30% |

| Effective tax rate | 24.55% | — |

Read Also:- Syncom Formulations Share Price Target Tomorrow 2025, 2026 To 2030