Salasar Techno Engineering is a well-known name in the infrastructure and engineering sector, specializing in power transmission, telecom, and railway projects. With increasing demand for infrastructure development, the company has strong growth potential. Salasar Techno Share Price on 4 March 2025 is 8.75 INR. This article will provide more details on Salasar Techno Share Price Target 2025, 2026 to 2030.

Salasar Techno Company Info

- Founded: 2001

- Headquarters: India

- Number of employees: 1,312 (2024)

- Subsidiaries: EMC Limited, Salasar Adorus Infra LLP

Salasar Techno Share Price Chart

Salasar Techno Share Price Details

- Today Open: 8.79

- Today High: 8.94

- Today Low: 8.64

- Mkt cap: 1.51KCr

- P/E ratio: 28.48

- Div yield: N/A

- 52-wk high: 24.75

- 52-wk low: 8.36

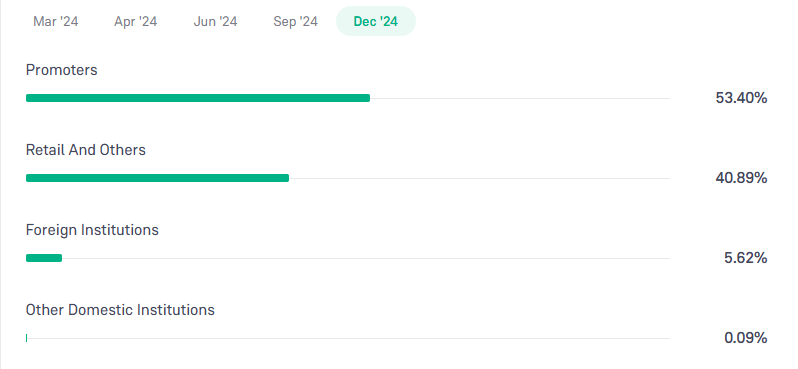

Salasar Techno Shareholding Pattern

- Promoters: 53.40%

- Foreign Institutions: 5.62%

- Mutual Funds: 0%

- Retails and others: 40.89%

- Domestic Institutions: 0.09%

Salasar Techno Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹25

- 2026 – ₹35

- 2027 – ₹45

- 2028 – ₹55

- 2029 – ₹70

- 2030 – ₹90

Salasar Techno Share Price Target 2025

Salasar Techno share price target 2025 Expected target could be ₹25. Salasar Techno Engineering, a key player in infrastructure and engineering solutions, has promising growth potential. Here are five key factors that could impact its share price target for 2025:

1. Strong Demand for Infrastructure Development

With increasing investments in infrastructure projects like power transmission, telecom towers, and railway electrification, Salasar Techno is well-positioned to benefit from this growing demand.

2. Government Policies and Support

Favorable government initiatives in sectors like renewable energy, smart cities, and rural electrification provide significant opportunities for the company’s expansion, boosting investor confidence.

3. Expansion into New Markets

Salasar Techno is actively expanding its presence in domestic and international markets. New contracts and partnerships can drive revenue growth and enhance its market position.

4. Technological Advancements and Innovation

Adopting new technologies in manufacturing and engineering solutions can improve efficiency, reduce costs, and give the company a competitive edge in the industry.

5. Strong Order Book and Execution Capability

A healthy order book and timely execution of projects are crucial for revenue growth. If the company successfully delivers high-value projects on time, it can positively impact its financial performance and share price.

Salasar Techno Share Price Target 2030

Salasar Techno share price target 2030 Expected target could be ₹90. While Salasar Techno has strong growth potential, certain risks and challenges could impact its share price by 2030. Here are five key concerns:

1. Dependence on Government Projects

A large portion of Salasar Techno’s revenue comes from government infrastructure projects. Any slowdown in government spending or policy changes could negatively impact growth and profitability.

2. Rising Raw Material Costs

Steel and other raw materials are essential for the company’s operations. Fluctuations in their prices can affect profit margins, making it challenging to maintain steady growth.

3. Intense Industry Competition

The infrastructure and engineering sector is highly competitive, with multiple players vying for contracts. Increased competition could put pressure on pricing and limit profit potential.

4. Project Delays and Execution Risks

Delays in project execution due to regulatory approvals, funding issues, or operational challenges can lead to cost overruns and affect the company’s financial performance.

5. Economic and Market Uncertainties

Global and domestic economic fluctuations, inflation, and currency exchange rates can impact investment in infrastructure projects. Any economic slowdown could reduce demand for the company’s services.

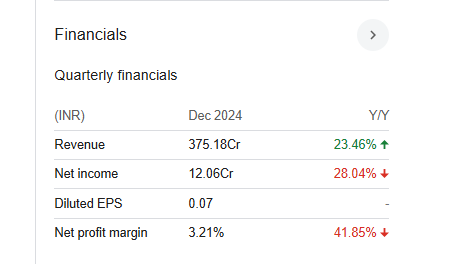

Financials Statement Of Salasar Techno

| (INR) | 2024 | Y/Y change |

| Revenue | 12.08B | 20.25% |

| Operating expense | 1.22B | 21.53% |

| Net income | 529.33M | 31.77% |

| Net profit margin | 4.38 | 9.50% |

| Earnings per share | — | — |

| EBITDA | 1.22B | 33.44% |

| Effective tax rate | 26.50% | — |

Read Also:- Jio Finance Share Price Target Tomorrow 2025, 2026 To 2030