Investors are always looking for opportunities in the financial sector, and SBFC Finance has been gaining attention for its strong business model and growth potential. With a focus on small business lending and retail financing, the company is steadily expanding its presence. SBFC Share Price on 27 March 2025 is 89.20 INR. This article will provide more details on SBFC Share Price Target 2025, 2026 to 2030.

SBFC Company Info

- Headquarters: India

- Number of employees: 3,758 (2024)

- Parent organization: SBFC Holdings Pte. Ltd.

- Subsidiaries: SBFC Home Finance Private Limited, Sbfc Employee Welfare Trust

SBFC Share Price Chart

SBFC Share Price Details

- Today Open: 88.01

- Today High: 90.00

- Today Low: 88.01

- Mkt cap: 9.68KCr

- P/E ratio: 29.70

- Div yield: N/A

- 52-wk high: 105.81

- 52-wk low: 77.05

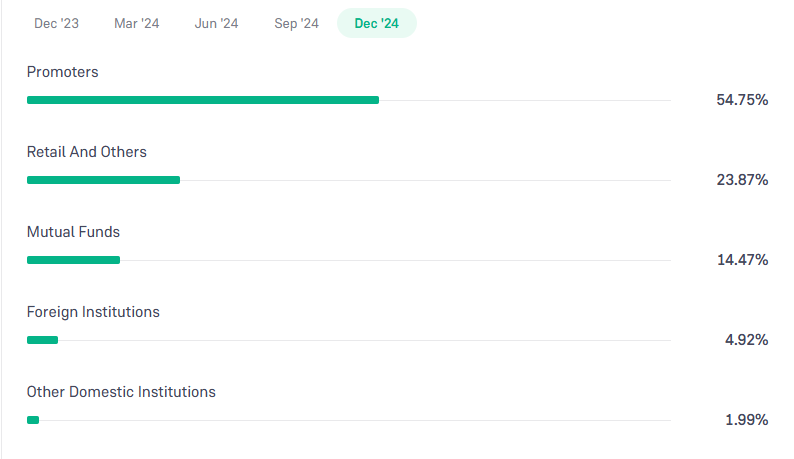

SBFC Shareholding Pattern

- Promoters: 54.75%

- Foreign Institutions: 4.92%

- Mutual Funds: 14.47%

- Retails and others: 23.87%

- Domestic Institutions: 1.99%

SBFC Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹110

- 2026 – ₹120

- 2027 – ₹130

- 2028 – ₹140

- 2029 – ₹150

- 2030 – ₹160

SBFC Share Price Target 2025

SBFC share price target 2025 Expected target could be ₹110. Here are 5 Key Factors Affecting Growth for SBFC Share Price Target 2025:

-

Strong Loan Growth – SBFC focuses on providing loans to small businesses and individuals, and its expansion in the lending sector can drive revenue growth and positively impact its share price.

-

Interest Rate Movements – Changes in interest rates directly affect the cost of borrowing and lending margins. A favorable interest rate environment can boost profitability.

-

Asset Quality & NPA Levels – The company’s ability to manage non-performing assets (NPAs) and maintain a healthy loan book will be crucial in determining investor confidence and stock performance.

-

Regulatory Policies – Any changes in financial sector regulations, RBI guidelines, or government initiatives related to NBFCs can significantly impact SBFC’s operations and growth prospects.

-

Market Sentiment & Economic Conditions – Overall economic growth, demand for credit, and investor sentiment toward the NBFC sector will influence SBFC’s stock price movement in 2025.

SBFC Share Price Target 2030

SBFC share price target 2030 Expected target could be ₹160. Here are 5 Key Factors Affecting Growth for SBFC Share Price Target 2030:

-

Expansion in Lending Operations – SBFC’s long-term growth depends on its ability to expand its loan portfolio, especially in underserved markets, boosting revenue and profitability.

-

Technological Advancements – Adoption of digital lending, AI-based credit assessments, and fintech collaborations can improve operational efficiency and attract more customers, supporting long-term growth.

-

Regulatory Changes & Compliance – Future changes in RBI policies and financial regulations for NBFCs will play a crucial role in shaping SBFC’s growth trajectory and risk management strategies.

-

Economic Growth & Market Conditions – India’s economic stability, inflation control, and overall financial sector performance will impact demand for loans and investor confidence in SBFC.

-

Competition & Industry Trends – The rise of fintech lenders and established banks expanding their digital services may affect SBFC’s market share, making innovation and customer retention strategies critical for long-term success.

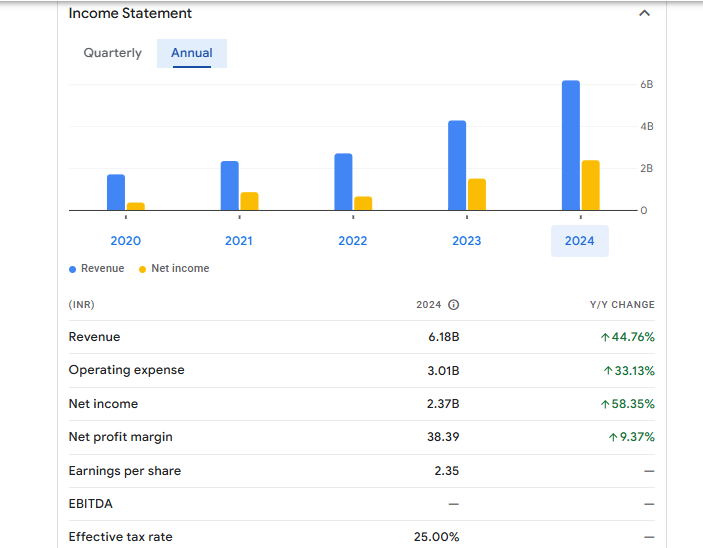

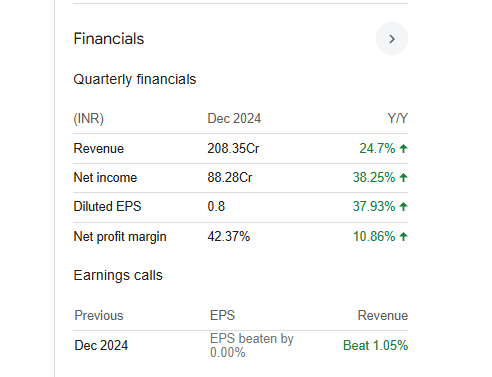

Financials Statement Of SBFC

| (INR) | 2024 | Y/Y change |

| Revenue | 6.18B | 44.76% |

| Operating expense | 3.01B | 33.13% |

| Net income | 2.37B | 58.35% |

| Net profit margin | 38.39 | 9.37% |

| Earnings per share | 2.35 | — |

| EBITDA | — | — |

| Effective tax rate | 25.00% | — |

Read Also:- Hazoor Multi Projects Share Price Target Tomorrow 2025, 2026 To 2030