SEPC (Shriram EPC) is a well-known company in the engineering and construction sector, focusing on infrastructure projects, water management, and renewable energy. Investors are keen to know its future growth potential and share price targets. Several factors, including government projects, financial performance, and market trends, will influence its stock movement. SEPC Share Price on 17 March 2025 is 15.18 INR. This article will provide more details on SEPC Share Price Target 2025, 2026 to 2030.

SEPC Company Info

- Headquarters: India

- Number of employees: 229 (2024)

- Subsidiaries: SEPC FZE, Hexa Windfram Private Limited

SEPC Share Price Chart

SEPC Share Price Details

- Today Open: 16.42

- Today High: 16.42

- Today Low: 15.18

- Mkt cap: 2.41KCr

- P/E ratio: 96.89

- Div yield: N/A

- 52-wk high: 33.45

- 52-wk low: 12.02

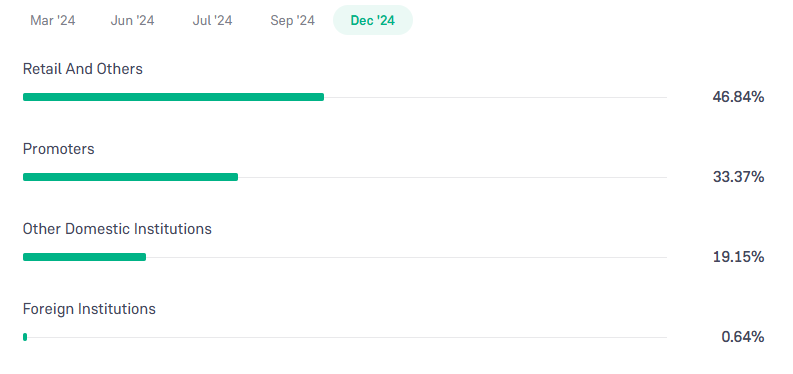

SEPC Shareholding Pattern

- Promoters: 33.37%

- Foreign Institutions: 0.64%

- Mutual Funds: 0%

- Retails and others: 46.84%

- Domestic Institutions: 19.15%

SEPC Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹35

- 2026 – ₹45

- 2027 – ₹55

- 2028 – ₹65

- 2029 – ₹75

- 2030 – ₹85

SEPC Share Price Target 2025

SEPC share price target 2025 Expected target could be ₹35. Here are 5 Key Factors Affecting Growth for SEPC Share Price Target 2025:

-

Infrastructure and Industrial Growth – SEPC (Shriram EPC) operates in the infrastructure and engineering sectors, benefiting from increased government spending on construction, water projects, and industrial development.

-

Order Book and New Contracts – The company’s ability to secure large-scale contracts in water treatment, renewable energy, and engineering projects will drive revenue and investor confidence.

-

Government Policies and Support – Favorable policies, such as investments in smart cities, irrigation, and energy projects, can boost SEPC’s growth prospects.

-

Financial Stability and Debt Management – Improving financial health, reducing debt, and ensuring steady cash flow will be crucial for sustainable growth and stock performance.

-

Technological Advancements and Expansion – Adoption of advanced engineering solutions and expansion into new markets can enhance SEPC’s competitive position and drive long-term growth.

SEPC Share Price Target 2030

SEPC share price target 2030 Expected target could be ₹85. Here are 5 Key Factors Affecting Growth for SEPC Share Price Target 2030:

-

Long-Term Infrastructure Development – SEPC’s growth will depend on large-scale infrastructure projects, including smart cities, water management, and industrial expansion.

-

Government Contracts and Public-Private Partnerships (PPPs) – Winning long-term contracts and forming strategic partnerships with the government and private sector will boost revenue and business sustainability.

-

Technological Advancements in Engineering Solutions – Adopting cutting-edge construction and engineering technologies will improve efficiency, reduce costs, and attract more clients.

-

Global Expansion and Diversification – Expanding into international markets and diversifying service offerings beyond core engineering solutions will create new revenue streams.

-

Financial Performance and Debt Reduction – A strong balance sheet, improved profit margins, and effective debt management will enhance investor confidence and positively impact share prices in the long run.

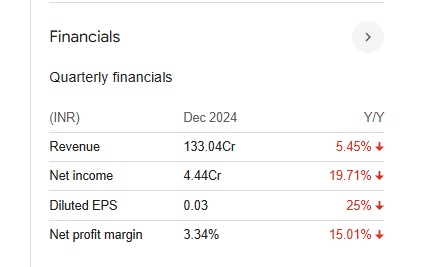

Financials Statement Of SEPC

| (INR) | 2024 | Y/Y change |

| Revenue | 5.61B | 48.08% |

| Operating expense | 727.74M | -43.26% |

| Net income | 227.84M | 564.61% |

| Net profit margin | 4.06 | 414.73% |

| Earnings per share | — | — |

| EBITDA | 254.31M | 139.98% |

| Effective tax rate | — | — |

Read Also:- Standard Glass Lining Technology Share Price Target Tomorrow 2025, 2026 To 2030