Siemens is a well-known global company with a strong presence in industrial automation, energy, and technology solutions. Investors are keen to know its future share price potential as the company continues to grow in smart manufacturing, renewable energy, and infrastructure projects. Siemens Share Price on 28 March 2025 is 217.60 EUR. This article will provide more details on Siemens Share Price Target 2025, 2026 to 2030.

Siemens Company Info

- CEO: Roland Busch (3 Feb 2021–)

- Founded: 1 October 1847, Berlin, Germany

- Founders: Werner von Siemens, Johann Georg Halske

- Headquarters: Munich, Germany

- Number of employees: 3,13,000 (2024)

- Revenue: 8,684.9 crores EUR (2019)

- Subsidiaries: Siemens Healthineers

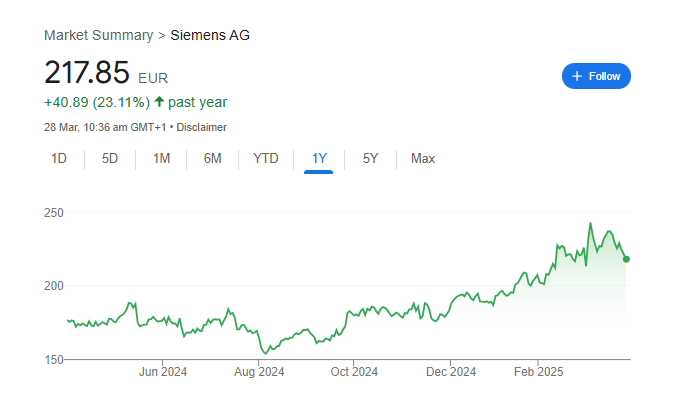

Siemens Share Price Chart

Siemens Share Price Details

- Today Open: 219.25

- Today High: 219.80

- Today Low: 217.20

- Mkt cap: 17.43KCr

- P/E ratio: 18.05

- Div yield: 2.39%

- 52-wk high: 244.85

- 52-wk low: 150.68

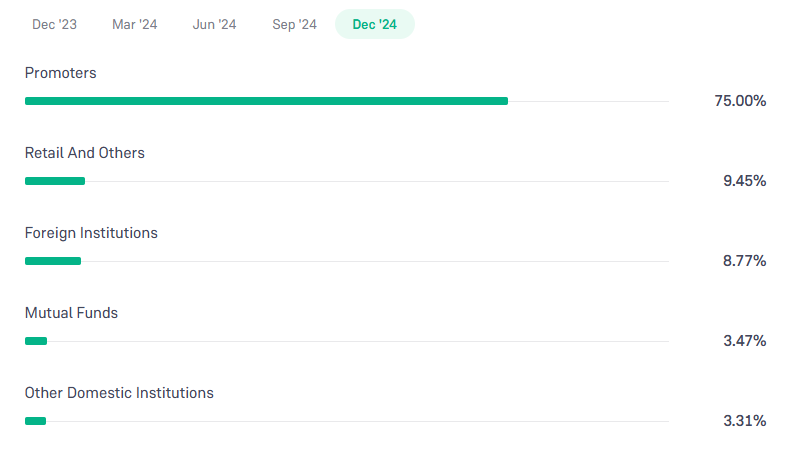

Siemens Shareholding Pattern

- Promoters: 75%

- Foreign Institutions: 8.77%

- Mutual Funds: 3.47%

- Retails and others: 9.45%

- Domestic Institutions: 3.31%

Siemens Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – EUR 245

- 2026 – EUR 290

- 2027 – EUR 330

- 2028 – EUR 370

- 2029 – EUR 410

- 2030 – EUR 450

Siemens Share Price Target 2025

Siemens share price target 2025 Expected target could be EUR 245. Here are 5 Key Factors Affecting Growth for Siemens Share Price Target 2025:

-

Expansion in Renewable Energy & Electrification

Siemens is heavily investing in renewable energy solutions, smart grids, and electrification projects. The increasing focus on clean energy and government initiatives will drive demand for its products and services. -

Technological Advancements & Digitalization

The company’s push towards industrial automation, IoT, and AI-driven solutions will enhance efficiency and open new revenue streams, positively impacting its share price growth. -

Government Infrastructure & Smart City Projects

Siemens is a key player in India’s smart city and infrastructure development projects. Increased government spending in these areas will boost the company’s long-term growth prospects. -

Global & Domestic Economic Conditions

Siemens operates in various markets worldwide, making it susceptible to global economic conditions, interest rates, and inflation. A stable economic environment will benefit its stock performance. -

Strong Order Book & Business Growth

Siemens has a robust order book in power generation, industrial automation, and transportation. A continuous inflow of new projects will ensure steady revenue growth, strengthening investor confidence.

Siemens Share Price Target 2030

Siemens share price target 2030 Expected target could be EUR 450. Here are 5 Key Factors Affecting Growth for Siemens Share Price Target 2030:

-

Growth in Automation & Industry 4.0

Siemens is a leader in industrial automation, AI, and digitalization. As industries move towards smart manufacturing and automation, demand for Siemens’ solutions will drive long-term growth. -

Renewable Energy & Electrification Expansion

With the world transitioning towards clean energy, Siemens’ investments in renewable energy, smart grids, and electric mobility will be key drivers of revenue and profitability by 2030. -

Government Infrastructure & Smart City Projects

Continued government initiatives in smart cities, metro rail projects, and infrastructure development will boost Siemens’ business in India and globally, supporting its share price growth. -

Global Market Expansion & Technological Innovations

Siemens’ expansion into emerging markets and advancements in AI, cybersecurity, and sustainable technologies will strengthen its global presence and revenue potential. -

Financial Stability & Consistent Revenue Growth

Strong financial performance, increasing order book value, and strategic acquisitions will enhance Siemens’ market position and positively impact its long-term share price growth.

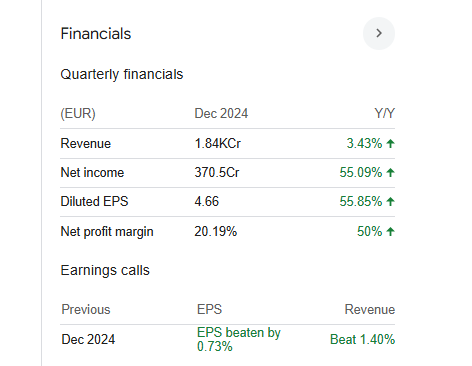

Financials Statement Of Siemens

| (INR) | 2024 | Y/Y change |

| Revenue | 18.35B | 3.43% |

| Operating expense | 5.03B | 5.72% |

| Net income | 3.71B | 55.09% |

| Net profit margin | 20.19 | 50.00% |

| Earnings per share | 2.14 | -29.17% |

| EBITDA | 2.84B | -6.92% |

| Effective tax rate | 24.36% | — |

Read Also:- Aditya Vision Share Price Target Tomorrow 2025, 2026 To 2030