Sona BLW Precision Forgings, also known as Sona Comstar, is a trusted name in the auto components industry. The company is well-known for its advanced technology and strong focus on electric vehicle (EV) parts. Over the years, it has earned the confidence of investors and customers alike with consistent performance and innovation. Sona BLW Precision Forgings Share Price on 11 April 2025 is 427.85 INR. This article will provide more details on Sona BLW Precision Forgings Share Price Target 2025, 2026 to 2030.

Sona BLW Precision Forgings Company Info

- CEO: Vivek Vikram Singh (5 Jul 2019–)

- Founded: 1995

- Headquarters: India

- Number of employees: 1,672 (2024)

- Parent organization: Sona Autocomp Holding Private Limited

- Subsidiaries: Sona Comstar eDrive Private Limited, NOVELIC.

Sona BLW Precision Forgings Share Price Chart

Sona BLW Precision Forgings Share Price Details

- Today Open: 428.70

- Today High: 430.50

- Today Low: 416.00

- Mkt cap: 26.60KCr

- P/E ratio: 43.58

- Div yield: 0.75%

- 52-wk high: 768.65

- 52-wk low: 380.00

Sona BLW Precision Forgings Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹770

- 2026 – ₹900

- 2027 – ₹1000

- 2028 – ₹1100

- 2029 – ₹1200

- 2030 – ₹1300

Sona BLW Precision Forgings Share Price Target 2025

Sona BLW Precision Forgings share price target 2025 Expected target could be ₹770. Here are five key factors influencing Sona BLW’s share price target for 2025:

-

Strong Electric Vehicle (EV) Segment Growth

Sona BLW’s revenue from Battery Electric Vehicles (BEVs) has shown significant growth, with BEV programs contributing 78% to the net order book of ₹23,100 crore as of Q2 FY25. This focus on the EV segment positions the company well for future growth.

-

Robust Financial Performance

In Q2 FY25, the company reported revenue of ₹925 crore, marking a 17% year-over-year growth. The EBITDA stood at ₹255 crore with a margin of 27.6%, and the net profit was ₹144 crore, reflecting a 16% YoY increase. Such strong financials support investor confidence.

-

Global Expansion Initiatives

Sona BLW has inaugurated a new manufacturing plant in Mexico to cater to the growing EV demand in North America. This expansion enhances the company’s global footprint and access to key markets.

-

Positive Analyst Outlook

Analysts have given Sona BLW a “Buy” rating with a target price of ₹725, reflecting optimism about the company’s growth prospects. This positive outlook can influence investor sentiment and share price.

-

Innovation in Automotive Technology

Sona BLW is focusing on developing advanced automotive systems and components, particularly for the EV market. Their commitment to innovation positions them as a key player in the evolving automotive industry.

Sona BLW Precision Forgings Share Price Target 2030

Sona BLW Precision Forgings share price target 2030 Expected target could be ₹1300.

Here are Several key factors are expected to influence Sona BLW’s growth trajectory:

-

Surging Electric Vehicle (EV) Adoption

India’s EV market is projected to experience a compound annual growth rate (CAGR) of 45.5%, with sales potentially reaching over 16 million units by 2030. Sona BLW, specializing in EV traction motors and control units, is well-positioned to capitalize on this trend.

-

Strategic Global Investments

The company plans to invest approximately $130 million globally over the next few years to support its electrification initiatives. These investments aim to enhance production capacities and technological capabilities, particularly in key markets like North America and Europe.

-

Technological Advancements

Sona BLW is focusing on developing high-power-density EV systems capable of handling high torque requirements with lightweight designs. These innovations are expected to improve vehicle efficiency and performance, making the company’s products more attractive to automakers.

-

Diversified Product Portfolio

The company’s broad range of products, including differential assemblies, drive motors, and e-axles, allows it to cater to various segments of the automotive industry. This diversification helps mitigate risks associated with dependence on specific products or markets.

-

Robust Financial Health

Sona BLW has demonstrated strong financial performance, with significant increases in profits, cash flow, and revenue over the past five years. Its debt-free status provides financial flexibility to invest in growth opportunities and withstand market fluctuations.

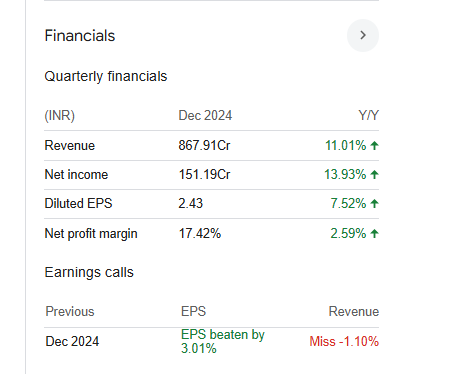

Financial Statement Of Sona BLW Precision Forgings

| (INR) | 2024 | Y/Y change |

| Revenue | 31.85B | 19.95% |

| Operating expense | 10.70B | 21.27% |

| Net income | 5.17B | 30.86% |

| Net profit margin | 16.24 | 9.07% |

| Earnings per share | 8.94 | 31.64% |

| EBITDA | 8.63B | 34.85% |

| Effective tax rate | 22.87% | — |

Read Also:- Sonata Software Share Price Target 2025, 2026 To 2030