Sonata Software is a well-known Indian IT services company that offers smart digital solutions across the globe. Over the years, it has gained trust for delivering quality work in areas like cloud computing, AI, and digital transformation. Investors looking for long-term growth often find Sonata an interesting choice due to its strong global presence and innovation-driven approach. Sonata Software Share Price on 11 April 2025 is 316.20 INR. This article will provide more details on Sonata Software Share Price Target 2025, 2026 to 2030.

Sonata Software Company Info

- CEO: Samir Dhir (8 Apr 2022–)

- Founded: 1986

- Headquarters: Bengaluru

- Number of employees: 6,043 (2024)

- Revenue: 5,553 crores INR (US₹700 million, 2022)

- Subsidiaries: Sonata Information Technology Limited.

Sonata Software Share Price Chart

Sonata Software Share Price Details

- Today Open: 316.90

- Today High: 324.70

- Today Low: 315.55

- Mkt cap: 8.77KCr

- P/E ratio: 20.54

- Div yield: 2.50%

- 52-wk high: 763.70

- 52-wk low: 286.40

Sonata Software Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹770

- 2026 – ₹900

- 2027 – ₹1100

- 2028 – ₹1300

- 2029 – ₹1500

- 2030 – ₹1700

Sonata Software Share Price Target 2025

Sonata Software share price target 2025 Expected target could be ₹770. Sonata Software is navigating a dynamic market landscape with several factors poised to influence its share price target for the year. Here are five key elements affecting its growth trajectory:

-

Strategic Focus on AI and Cloud Services

Sonata is intensifying its investments in artificial intelligence and cloud computing, aiming to derive 20% of its revenue from AI-enabled services by FY27. This strategic shift aligns with global digital transformation trends and positions the company for substantial growth in these high-demand sectors.

-

Expansion in Key International Markets

The company has reported significant revenue growth in the U.S., which now contributes 72% of its total revenue. Additionally, Sonata has secured major deals in the U.S. and Australia, indicating a strong foothold in these markets and potential for continued expansion.

-

Robust Deal Pipeline and Client Acquisitions

Sonata has secured several substantial deals, including data modernization for a leading U.S. financial institution and cloud services for a prominent technology company. These wins not only boost immediate revenue but also enhance the company’s reputation and client base.

-

Operational Challenges Impacting Margins

Despite revenue growth, Sonata faces margin pressures due to increased operating expenses from workforce expansion and investments in strategic sectors like healthcare and BFSI. These challenges have led to a YoY decline in EBIT and PAT margins, affecting short-term profitability.

-

Analyst Outlook and Share Price Targets

KRChoksey has assigned an “ACCUMULATE” rating to Sonata Software, with a revised target price of ₹679, reflecting a potential upside of 7.5% from its current price. The target price considers the company’s strategic initiatives in AI and cloud services, balanced against near-term margin challenges.

Sonata Software Share Price Target 2030

Sonata Software share price target 2030 Expected target could be ₹1700. Sonata Software is strategically positioned for growth, with several key factors expected to influence its share price target by 2030:

-

Expansion in AI and Cloud Services

Sonata is intensifying its investments in artificial intelligence (AI) and cloud computing, aiming to derive 20% of its revenue from AI-enabled services by FY27. This strategic shift aligns with global digital transformation trends and positions the company for substantial growth in these high-demand sectors.

-

Global Market Penetration

The company has reported significant revenue growth in the U.S., which now contributes 72% of its total revenue. Additionally, Sonata has secured major deals in the U.S. and Australia, indicating a strong foothold in these markets and potential for continued expansion.

-

Commitment to Sustainability and ESG

Sonata’s 2023–24 Sustainability Report highlights its dedication to environmental, social, and governance (ESG) initiatives. The company emphasizes equitable growth for employees, communities, and stakeholders, aiming to deliver a positive impact across people, planet, and prosperity.

-

Strategic Acquisitions and Partnerships

Sonata has made strategic acquisitions, such as the purchase of Encore IT Services Solutions Private Limited, to enhance its service offerings and expand its global footprint. These moves are expected to strengthen its position in key markets and drive revenue growth.

-

Positive Analyst Outlook

Analysts have given Sonata an “ACCUMULATE” rating, with a revised target price of ₹679, reflecting a potential upside of 7.5% from its current price. The target price considers the company’s strategic initiatives in AI and cloud services, balanced against near-term margin challenges.

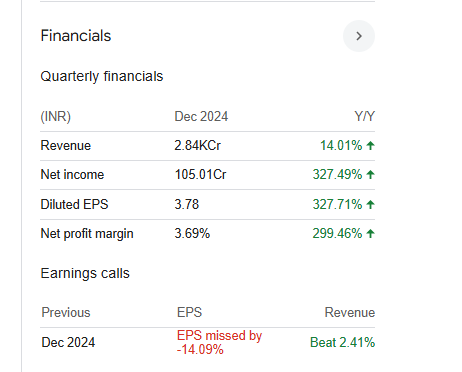

Financial Statement Of Sonata Software

| (INR) | 2024 | Y/Y change |

| Revenue | 28.43B | 14.01% |

| Operating expense | 2.75B | 25.03% |

| Net income | 1.05B | 327.49% |

| Net profit margin | 3.69 | 299.46% |

| Earnings per share | 3.78 | -18.20% |

| EBITDA | 1.57B | -13.60% |

| Effective tax rate | 23.25% | — |

Read Also:- Abbott Laboratories Share Price Target Tomorrow 2025, 2026 To 2030