Sri Adhikari Brothers is a well-known name in the Indian media and entertainment industry. Investors looking at this stock often wonder about its future growth and potential returns. The company’s focus on digital expansion, content creation, and advertising revenue plays a crucial role in its stock performance. If the media industry continues to grow and the company adapts well to market trends, its share price could see positive movement. Sri Adhikari Brothers Share Price on 28 March 2025 is 608.80 INR. This article will provide more details on Sri Adhikari Brothers Share Price Target 2025, 2026 to 2030.

Sri Adhikari Brothers Company Info

- Headquarters: India

- Number of employees: 1 (2024).

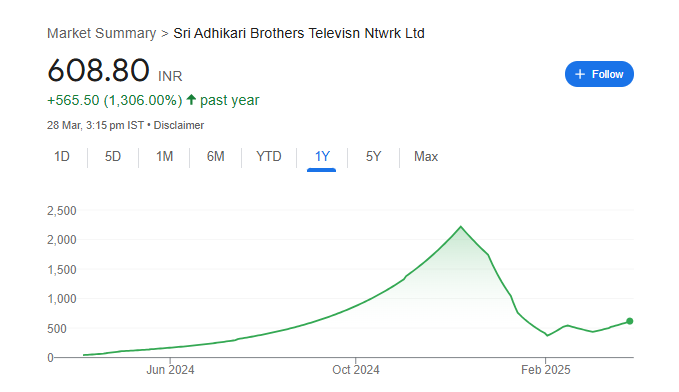

Sri Adhikari Brothers Share Price Chart

Sri Adhikari Brothers Share Price Details

- Today Open: 608.80

- Today High: 608.80

- Today Low: 608.80

- Mkt cap: 1.54KCr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 2,219.95

- 52-wk low: 41.25

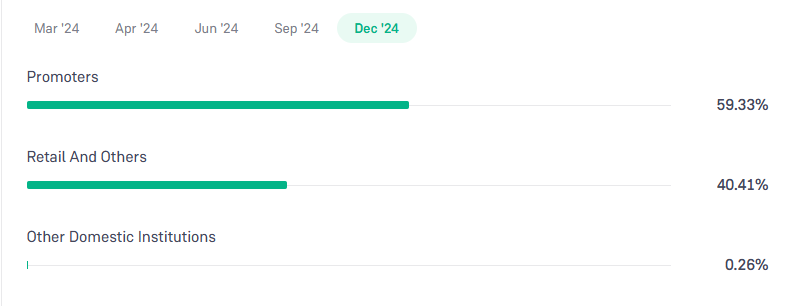

Sri Adhikari Brothers Shareholding Pattern

- Promoters: 59.33%

- Foreign Institutions: 0%

- Mutual Funds: 0%

- Retails and others: 40.41%

- Domestic Institutions: 0.26%

Sri Adhikari Brothers Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹2220

- 2026 – ₹2700

- 2027 – ₹3200

- 2028 – ₹3600

- 2029 – ₹4200

- 2030 – ₹4600

Sri Adhikari Brothers Share Price Target 2025

Sri Adhikari Brothers share price target 2025 Expected target could be ₹2220. Here are five key factors that may affect the growth of Sri Adhikari Brothers’ share price target for 2025:

-

Performance in the Media & Entertainment Sector – The company’s success depends on the growth of television, digital content, and advertising revenues. A strong audience base and increased ad spending can drive growth.

-

Digital Transformation & OTT Presence – Expansion into digital platforms and OTT services can open new revenue streams. If the company adapts well to changing media consumption habits, it may see higher valuations.

-

Financial Health & Debt Management – Investors will closely watch the company’s financial stability, debt levels, and profitability. Strong earnings and reduced liabilities can boost investor confidence.

-

Regulatory & Industry Changes – Government policies, content regulations, and changes in broadcasting laws can impact business operations. Favorable regulations can support growth, while strict policies might pose challenges.

-

Market Sentiment & Investor Confidence – Stock price movement will also depend on overall market trends, economic conditions, and investor sentiment toward small-cap media stocks. A positive outlook on the industry can drive demand for the stock.

Sri Adhikari Brothers Share Price Target 2030

Sri Adhikari Brothers share price target 2030 Expected target could be ₹4600. Here are five key factors that may influence the growth of Sri Adhikari Brothers’ share price target for 2030:

-

Expansion in Digital & OTT Platforms – The shift from traditional television to digital streaming will be a major factor. If the company successfully grows its OTT presence and digital content, it could see long-term revenue growth.

-

Advertising Revenue & Brand Collaborations – The company’s ability to attract advertisers and form strategic partnerships with brands will impact its profitability. Increased ad spending in the media industry can drive higher revenues.

-

Innovation & Content Quality – Success in the media sector depends on delivering engaging and high-quality content. Strong programming, unique content, and audience engagement will determine the company’s market position.

-

Financial Stability & Debt Control – Sustainable growth requires strong financial management. If Sri Adhikari Brothers can maintain healthy cash flow, reduce debt, and improve profitability, it will enhance investor confidence.

-

Industry & Economic Trends – The overall growth of the entertainment industry, advancements in technology, and economic conditions will influence the company’s long-term performance. A booming media sector can help the stock achieve higher valuations.

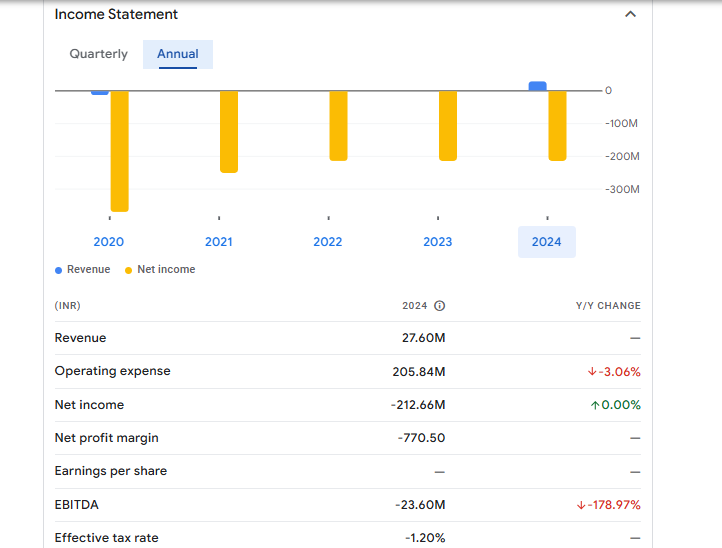

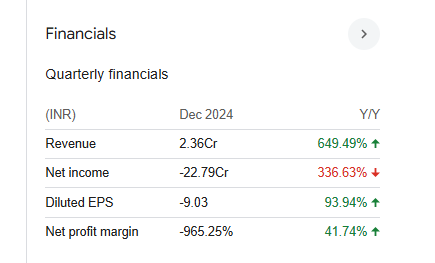

Financials Statement Of Sri Adhikari Brothers

| (INR) | 2024 | Y/Y change |

| Revenue | 27.60M | — |

| Operating expense | 205.84M | -3.06% |

| Net income | -212.66M | 0.00% |

| Net profit margin | -770.50 | — |

| Earnings per share | — | — |

| EBITDA | -23.60M | -178.97% |

| Effective tax rate | -1.20% | — |

Read Also:- Siemens Share Price Target Tomorrow 2025, 2026 To 2030