Investors looking at Standard Glass Lining Technology are curious about its future growth potential. As a company involved in advanced glass lining solutions for industrial use, its stock performance depends on various factors like industry demand, technological advancements, and market trends. Standard Glass Lining Technology Share Price on 11 March 2025 is 141.00 INR. This article will provide more details on Standard Glass Lining Technology Share Price Target 2025, 2026 to 2030.

Standard Glass Lining Technology Company Info

- Founded: 2012

- Headquarters: India

- Number of employees: 460 (2024)

- Subsidiary: Standard Engineering Solutions Private Limited

Standard Glass Lining Technology Share Price Chart

Standard Glass Lining Technology Share Price Details

- Today Open: 142.10

- Today High: 144.97

- Today Low: 138.39

- Mkt cap: 2.81KCr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 213.80

- 52-wk low: 124.00

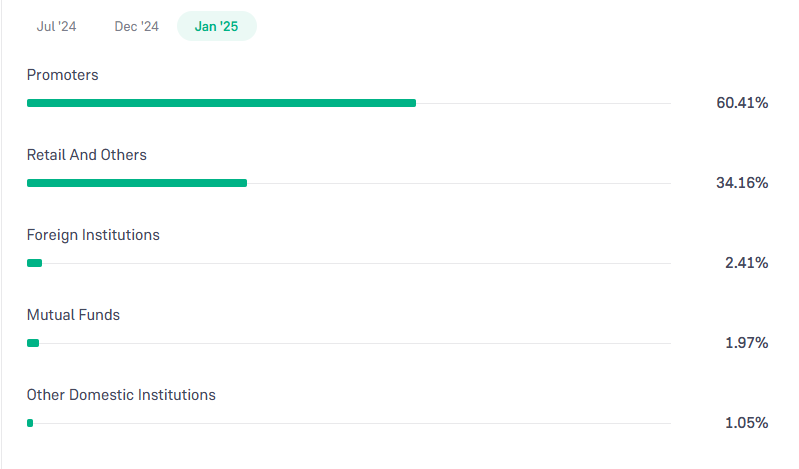

Standard Glass Lining Technology Shareholding Pattern

- Promoters: 60.41%

- Foreign Institutions: 2.41%

- Mutual Funds: 1.97%

- Retails and others: 34.16%

- Domestic Institutions: 1.05%

Standard Glass Lining Technology Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹215

- 2026 – ₹270

- 2027 – ₹320

- 2028 – ₹370

- 2029 – ₹420

- 2030 – ₹470

Standard Glass Lining Technology Share Price Target 2025

Standard Glass Lining Technology share price target 2025 Expected target could be ₹215. Standard Glass Lining Technology Limited (SGLTL) is a leading manufacturer of specialized equipment for the pharmaceutical, chemical, and food & beverage industries. Several key factors are expected to influence the company’s growth and, consequently, its share price target for 2025:

-

Robust Financial Performance

SGLTL reported a 33% year-on-year revenue growth for the first nine months of FY25, reaching ₹45,493.22 lakh. This strong financial performance reflects the company’s solid business fundamentals and operational excellence. -

Successful IPO and Capital Infusion

The company raised ₹210 crore through its initial public offering (IPO) in January 2025, enhancing its financial position and enabling investments in growth initiatives. -

Diversified Product Portfolio and Clientele

SGLTL’s extensive range of products caters to various industries, with a strong client base including prominent pharmaceutical companies such as Aurobindo Pharma, Granules India, and Natco Pharma. This diversification supports revenue stability and growth prospects. -

Advancements in Manufacturing Processes

The company’s in-house capabilities to manufacture specialized engineering equipment position it well to meet the evolving demands of the pharmaceutical and chemical sectors, driving future revenue growth. -

Market Demand for Glass-Lined Equipment

The exceptional corrosion resistance and durability of glass-lined equipment make it a preferred choice in industries such as pharmaceuticals and chemicals, supporting SGLTL’s growth in this segment.

Standard Glass Lining Technology Share Price Target 2030

Standard Glass Lining Technology share price target 2030 Expected target could be ₹470. Here are 5 Risks and Challenges for Standard Glass Lining Technology Share Price Target 2030:

-

Market Competition and Pricing Pressure

The industrial equipment sector is highly competitive, with domestic and international players offering similar products. Increased competition could lead to pricing pressure, impacting profitability and growth. -

Raw Material Price Volatility

The company relies on raw materials such as glass and specialized metals. Any significant fluctuation in raw material prices could affect production costs, reducing margins and impacting financial stability. -

Dependence on Specific Industries

Standard Glass Lining Technology primarily serves the pharmaceutical, chemical, and food processing industries. Any slowdown in these sectors due to economic downturns or regulatory changes could negatively impact demand for its products. -

Regulatory and Compliance Risks

The company operates in a sector with stringent safety and environmental regulations. Any failure to comply with these regulations or changes in policies could result in legal challenges, fines, or disruptions in business operations. -

Global Economic Uncertainty

Economic downturns, geopolitical tensions, or supply chain disruptions could impact the company’s operations and export potential. Fluctuations in currency exchange rates may also pose risks to international revenue streams.

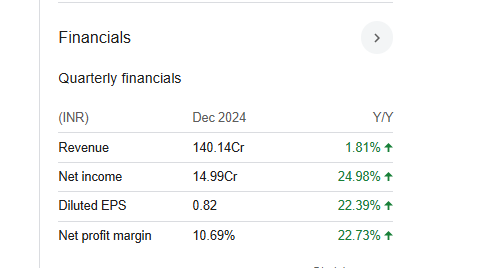

Financials Statement Of Standard Glass Lining Technology

| (INR) | 2024 | Y/Y change |

| Revenue | 5.44B | 9.26% |

| Operating expense | 1.39B | 4.86% |

| Net income | 583.84M | 9.28% |

| Net profit margin | 10.74 | 0.00% |

| Earnings per share | — | — |

| EBITDA | 907.79M | 11.32% |

| Effective tax rate | 24.80% | — |

Read Also:- Ajax Engineering Share Price Target Tomorrow 2025, 2026 To 2030