Syncom Formulations (India) Ltd. is a well-known name in the pharmaceutical industry, offering a wide range of affordable and quality medicines. Over the years, the company has shown steady growth and caught the attention of many investors. If you are thinking about investing in Syncom or are simply curious about its future, understanding its share price target can help you make better decisions. Syncom Formulations Share Price on 9 April 2025 is 16.71 INR. This article will provide more details on Syncom Formulations Share Price Target 2025, 2026 to 2030.

Syncom Formulations Company Info

- Headquarters: India

- Number of employees: 998 (2024)

- Subsidiaries: Vincit Biotech International Private Limited, Synmex Pharma Private Limited, Sante Biotech Private Limited.

Syncom Formulations Share Price Chart

Syncom Formulations Share Price Details

- Today Open: 16.77

- Today High: 16.96

- Today Low: 16.50

- Mkt cap: 1.57KCr

- P/E ratio: 36.65

- Div yield: N/A

- 52-wk high: 27.90

- 52-wk low: 10.95

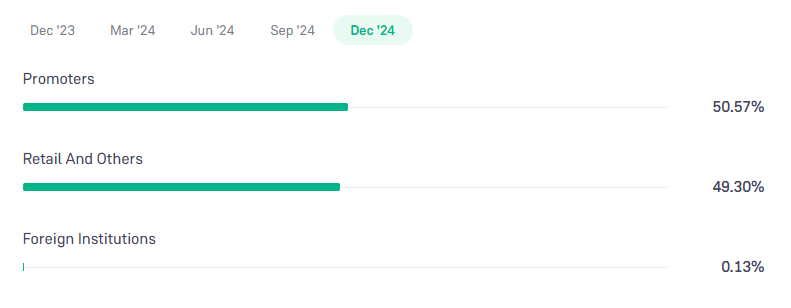

Syncom Formulations Shareholding Pattern

- Promoters: 50.57%

- Foreign Institutions: 0.13%

- Mutual Funds: 0%

- Retails and others: 49.30%

- Domestic Institutions: 0%

Syncom Formulations Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹30

- 2026 – ₹33

- 2027 – ₹36

- 2028 – ₹39

- 2029 – ₹42

- 2030 – ₹45

Syncom Formulations Share Price Target 2025

Syncom Formulations share price target 2025 Expected target could be ₹30. Several key factors are influencing the company’s growth and could impact its share price target for 2025:

-

Financial Performance

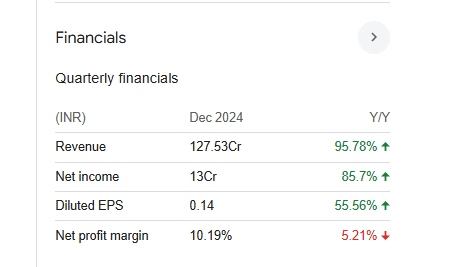

In Q3 FY2024-2025, Syncom Formulations reported a net profit of ₹13 crore, an 85.71% increase compared to the same period the previous year. This substantial growth indicates strong operational performance and profitability.

-

Debt Management

The company has effectively managed its debt, maintaining a net cash position of ₹77.76 crore. This healthy balance sheet provides financial stability and flexibility for future investments.

-

Industry Growth

India’s pharmaceutical sector is experiencing robust growth, driven by increasing healthcare spending, a growing population, and a focus on producing affordable generic drugs. Syncom Formulations is well-positioned to benefit from these industry trends.

-

Sales Growth and Return on Equity

Over the past five years, the company has delivered a modest sales growth of 6.60% and a return on equity of 8.77% over the last three years. While positive, these figures suggest room for improvement in enhancing shareholder value.

-

Market Valuation

Analysts have assessed the intrinsic value of Syncom Formulations’ stock at ₹8.24, indicating that the current market price may be overvalued by approximately 52%. This suggests that investors should exercise caution and conduct thorough analysis before making investment decisions.

Syncom Formulations Share Price Target 2030

Syncom Formulations share price target 2030 Expected target could be ₹45. Several key factors are expected to influence the company’s growth and share price:

-

Industry Growth

India’s pharmaceutical sector is projected to expand significantly by 2030, driven by increasing healthcare spending, a growing population, and a focus on producing affordable generic drugs. Syncom Formulations is well-positioned to benefit from these industry trends.

-

Financial Performance

The company’s financial health, including metrics like return on equity (ROE) and sales growth, will play a crucial role in its long-term growth. As of now, Syncom Formulations has a low ROE of 8.77% over the last three years and a sales growth of 6.60% over the past five years, indicating areas for potential improvement.

-

Market Valuation

Analysts have assessed the intrinsic value of Syncom Formulations’ stock at ₹8.24, suggesting that the current market price may be overvalued by approximately 52%. This indicates that investors should exercise caution and conduct thorough analysis before making investment decisions.

-

Technological Advancements

Investments in research and development to introduce new and innovative products can enhance Syncom’s market position and drive growth. Embracing technological advancements in manufacturing and distribution will be vital to meet evolving industry demands.

-

Regulatory Environment

The pharmaceutical industry is highly regulated. Changes in government policies, compliance requirements, and international trade agreements can impact Syncom’s operations and profitability. Staying adaptable to regulatory changes will be essential for sustained growth.

Financial Statement Of Syncom Formulations

| (INR) | 2024 | Y/Y change |

| Revenue | 2.63B | 17.45% |

| Operating expense | 806.80M | 20.65% |

| Net income | 253.14M | 26.13% |

| Net profit margin | 9.61 | 7.37% |

| Earnings per share | — | — |

| EBITDA | 293.90M | 51.45% |

| Effective tax rate | 25.44% | — |

Read Also:- Genus Power Share Price Target Tomorrow 2025, 2026 To 2030