Taneja Aerospace & Aviation Ltd. (TAAL) is a notable player in India’s aerospace and defense sector, offering services like aircraft manufacturing, maintenance, and airfield management. The company’s share price has experienced fluctuations, with a 52-week range between ₹309 and ₹710 as of December 2024. Looking ahead, various analyses project the share price to reach between ₹1,800 and ₹2,100 by 2030, depending on the company’s performance and market conditions. Taneja Aerospace Share Price on 12 April 2025 is 278.70 INR. This article will provide more details on Taneja Aerospace Share Price Target 2025, 2026 to 2030.

Taneja Aerospace Company Info

- Founded: 1988

- Headquarters: India

- Number of employees: 31 (2024)

- Parent organization: Indian Seamless Group

- Subsidiaries: TAAL Technologies Pvt. Ltd., First Airways, Inc.

Taneja Aerospace Share Price Chart

Taneja Aerospace Share Price Details

- Today Open: 285.00

- Today High: 285.00

- Today Low: 278.70

- Mkt cap: 710.70Cr

- P/E ratio: 48.94

- Div yield: 0.90%

- 52-wk high: 710.00

- 52-wk low: 218.55

Taneja Aerospace Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹710

- 2026 – ₹900

- 2027 – ₹1100

- 2028 – ₹1300

- 2029 – ₹1500

- 2030 – ₹1700

Taneja Aerospace Share Price Target 2025

Taneja Aerospace share price target 2025 Expected target could be ₹710. Here are five key factors that could influence the growth of Taneja Aerospace & Aviation Ltd.’s share price by 2025:

-

Expansion in India’s Aviation Sector

India’s aviation industry is experiencing rapid growth, with expectations of a substantial increase in the aircraft fleet size over the next five years. This expansion presents significant opportunities for companies like Taneja Aerospace, which provides aircraft maintenance and manufacturing services. -

Diversified Service Offerings

Taneja Aerospace offers a range of services, including aircraft maintenance, avionics retrofitting, and airfield management. This diversification allows the company to tap into various revenue streams, enhancing its potential for growth. -

Financial Performance and Profitability

The company has demonstrated positive financial metrics, with a net income of ₹125.8 million and a profitability score of 64/100. These indicators suggest a stable financial foundation, which could support future growth. -

Investor Sentiment and Market Activity

Recent market activity shows a surge in investor interest, with the stock gaining 25.88% over a six-day period. Positive investor sentiment can drive share prices upward, reflecting confidence in the company’s prospects. -

Challenges in Revenue Growth

Despite the positive indicators, the company has faced challenges, including a -1.50% sales growth over the past five years and a low return on equity of 9.23%. Addressing these issues will be crucial for sustaining long-term growth.

Taneja Aerospace Share Price Target 2030

Taneja Aerospace share price target 2030 Expected target could be ₹1700. Here are five key factors that could influence the growth of Taneja Aerospace & Aviation Ltd.’s share price by 2030:

-

Diversified Service Portfolio

Taneja Aerospace offers a range of services, including aircraft maintenance, avionics retrofitting, and airfield management. This diversification allows the company to tap into various revenue streams, enhancing its potential for growth. -

Global Aerospace Market Expansion

The global aerospace and defense materials market is projected to reach $34.4 billion by 2030, indicating robust industry growth. Taneja Aerospace, being part of this sector, stands to benefit from increased demand for aerospace components and services. -

Financial Performance and Investor Confidence

The company has demonstrated positive financial metrics, with a net income of ₹125.8 million and a profitability score of 64/100. These indicators suggest a stable financial foundation, which could support future growth. -

Technological Advancements and Innovation

Taneja Aerospace’s involvement in avionics retrofitting and other modifications positions it well to capitalize on technological advancements in the aerospace industry. Staying ahead with innovation can lead to increased demand for its services. -

Market Sentiment and Share Price Projections

Investor sentiment plays a crucial role in share price movements. Projections suggest that Taneja Aerospace’s share price could reach between ₹1,944 to ₹2,333 by 2030, reflecting positive market expectations.

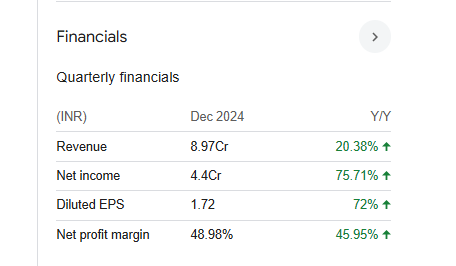

Financial Statement Of Taneja Aerospace

| (INR) | 2024 | Y/Y change |

| Revenue | 303.52M | -4.72% |

| Operating expense | 120.29M | 20.12% |

| Net income | 111.31M | 1.32% |

| Net profit margin | 36.67 | 6.32% |

| Earnings per share | — | — |

| EBITDA | 190.97M | 2.58% |

| Effective tax rate | 28.20% | — |

Read Also:- Resourceful Automobile Share Price Target 2025, 2026 To 2030