Tips Industries is one of India’s well-known music and film production companies. With a strong presence in the entertainment industry for many years, Tips has built a large library of songs and movies that continue to attract audiences across generations. In today’s digital world, the company is also growing its reach through online platforms like YouTube, Spotify, and other music streaming apps. Tips Industries Share Price on 11 April 2025 is 651.05 INR. This article will provide more details on Tips Industries Share Price Target 2025, 2026 to 2030.

Tips Industries Company Info

- Headquarters: India, Mumbai

- Number of employees: 50 (2024)

- Subsidiary: TIPS Films Private Limited.

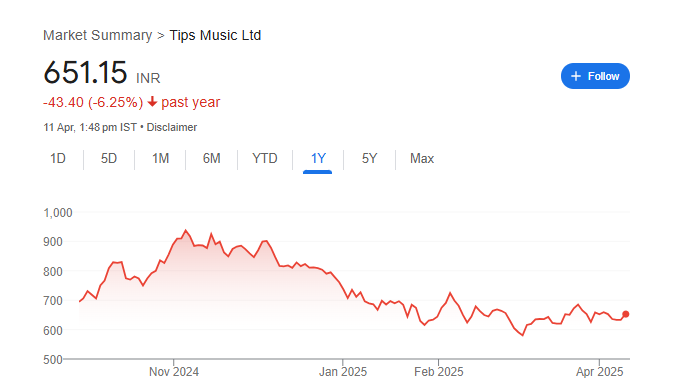

Tips Industries Share Price Chart

Tips Industries Share Price Details

- Today Open: 652.95

- Today High: 663.00

- Today Low: 640.60

- Mkt cap: 8.33KCr

- P/E ratio: 51.54

- Div yield: 1.08%

- 52-wk high: 950.00

- 52-wk low: 551.30

Tips Industries Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹950

- 2026 – ₹1100

- 2027 – ₹1250

- 2028 – ₹1400

- 2029 – ₹1550

- 2030 – ₹1700

Tips Industries Share Price Target 2025

Tips Industries share price target 2025 Expected target could be ₹950. Here are five key factors influencing Tips Industries Ltd.’s share price target for 2025:

-

Robust Financial Performance

Tips Industries has demonstrated strong financial health, boasting a profitability score of 91/100. The company has achieved an exceptional 3-year average Return on Equity (ROE) of 68% and Return on Invested Capital (ROIC) of 116%. Additionally, it maintains a positive free cash flow of ₹2.2 billion and positive operating income of ₹1.9 billion.

-

Strong Solvency Position

The company’s solvency score stands at 81/100, indicating a solid financial foundation. With a high Altman Z-Score of 45.67, negative net debt of ₹-2.3 billion, and a low debt-to-equity ratio of 0.01, Tips Industries showcases financial stability and low leverage.

-

Positive Market Sentiment

Tips Industries has received a ‘Buy’ rating from MarketsMOJO, attributed to its strong management efficiency, low debt-to-equity ratio, and healthy long-term growth prospects. Notably, the company has achieved a high ROE of 40.61%, reflecting efficient management practices.

-

Favorable Industry Trends

The entertainment sector, encompassing music and media, is experiencing significant growth. As consumer demand for digital content rises, companies like Tips Industries are well-positioned to capitalize on these trends, potentially driving revenue and share price growth.

-

Technical Indicators and Price Targets

Technical analysis suggests that Tips Industries’ share price is in an uptrend, with potential targets ranging from ₹699 to ₹1,714.90. These targets serve as support and resistance levels, indicating possible future price movements based on market dynamics.

Tips Industries Share Price Target 2030

Tips Industries share price target 2030 Expected target could be ₹1700. Here are several key factors are expected to influence Tips Industries Ltd.’s growth trajectory:

-

Expansion of Digital Music Streaming

The global shift towards digital music consumption continues to accelerate. Tips Industries has been actively releasing new music content and leveraging digital platforms to reach a wider audience. This trend is expected to bolster the company’s revenue streams and market presence by 2030.

-

Robust Financial Performance

Tips Industries has demonstrated strong financial health, boasting a profitability score of 91/100. The company has achieved an exceptional 3-year average Return on Equity (ROE) of 68% and Return on Invested Capital (ROIC) of 116%. Additionally, it maintains a positive free cash flow of ₹2.2 billion and positive operating income of ₹1.9 billion.

-

Strategic Partnerships and Collaborations

The company’s collaborations with major streaming platforms and content creators are expected to enhance its distribution network and content library. These strategic alliances are likely to contribute to sustained growth and a stronger market position by 2030.

-

Market Expansion and Diversification

Tips Industries is exploring opportunities to expand its footprint in international markets and diversify its content offerings. This includes venturing into regional languages and different music genres, which can attract a broader audience and open new revenue channels.

-

Technological Advancements and Innovation

Embracing new technologies, such as artificial intelligence for music recommendation and blockchain for rights management, can enhance user experience and operational efficiency. Staying at the forefront of technological innovation is crucial for maintaining competitiveness in the evolving music industry landscape.

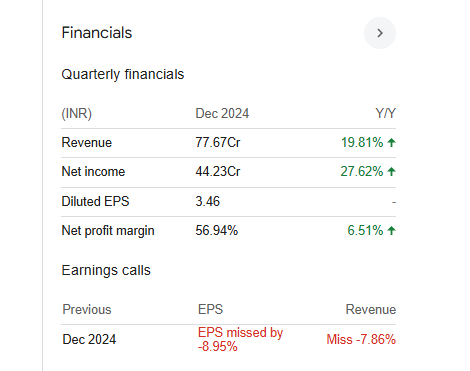

Financial Statement Of Tips Industries

| (INR) | 2024 | Y/Y change |

| Revenue | 2.42B | 29.34% |

| Operating expense | 707.03M | -9.75% |

| Net income | 1.27B | 66.18% |

| Net profit margin | 52.64 | 28.48% |

| Earnings per share | — | — |

| EBITDA | 1.60B | 58.22% |

| Effective tax rate | 25.43% | — |

Read Also:- Tarc Share Price Target 2025, 2026 To 2030