Titan is one of the most trusted brands in India, known for its high-quality jewelry, watches, and eyewear. Investors are always curious about its future growth and stock performance. If you are looking for insights into Titan’s share price, you are in the right place. Titan Share Price on 21 March 2025 is 3,166.25 INR. This article will provide more details on Titan Share Price Target 2025, 2026 to 2030.

Titan Company Info

- Founded: 1984

- Founder: Xerxes Desai

- Headquarters: Bengaluru

- Number of employees: 8,680 (2024)

- Parent organizations: Tata Group, Tata Sons, Tamil Nadu Industrial Development Corporation Limited

- Revenue: 51,617 crores INR (US$6.5 billion, 2024)

- Subsidiaries: CaratLane, Titan Engineering & Automation Limited

Titan Share Price Chart

Titan Share Price Details

- Today Open: 3,186.95

- Today High: 3,190.00

- Today Low: 3,154.95

- Mkt cap: 2.81LCr

- P/E ratio: 86.82

- Div yield: 0.35%

- 52-wk high: 3,867.00

- 52-wk low: 2,985.05

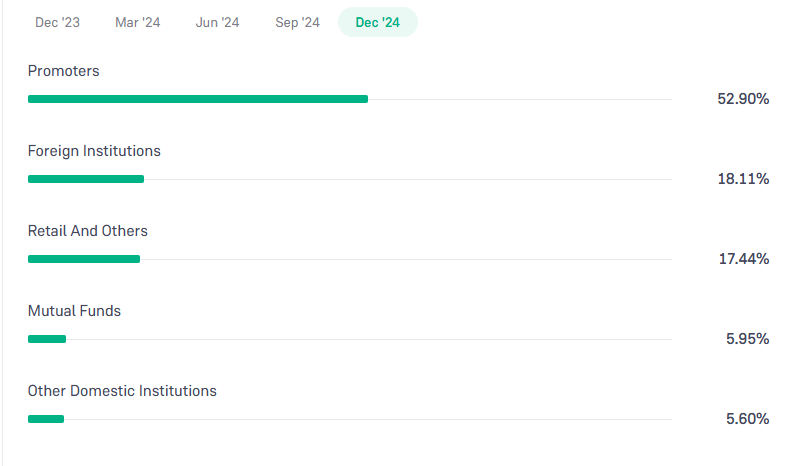

Titan Shareholding Pattern

- Promoters: 52.90%

- Foreign Institutions: 18.11%

- Mutual Funds: 5.95%

- Retails and others: 17.44%

- Domestic Institutions: 5.60%

Titan Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹3870

- 2026 – ₹4454

- 2027 – ₹4950

- 2028 – ₹5564

- 2029 – ₹6040

- 2030 – ₹6574

Titan Share Price Target 2025

Titan share price target 2025 Expected target could be ₹3870. Here are five key factors affecting the growth of Titan’s share price target for 2025:

-

Strong Brand Presence – Titan’s well-established brands like Tanishq, Fastrack, and Titan Watches contribute to consistent revenue growth and customer loyalty.

-

Growing Demand for Jewelry – Rising disposable income and increasing gold consumption in India can drive higher sales for its jewelry segment, boosting overall growth.

-

Retail Expansion – Titan’s continuous expansion into tier-2 and tier-3 cities helps it capture a broader customer base, leading to higher sales and market share.

-

Diversification and Innovation – The company’s focus on smartwatches, eyewear, and perfumes adds new revenue streams, increasing its overall growth potential.

-

Economic and Market Trends – Factors like inflation, interest rates, and consumer spending patterns can impact Titan’s profitability and stock performance in 2025.

Titan Share Price Target 2030

Titan share price target 2030 Expected target could be ₹6574. Here are five key factors affecting the growth of Titan’s share price target for 2030:

-

Jewelry Market Expansion – With India’s growing middle class and increasing gold demand, Titan’s Tanishq brand is expected to benefit from long-term industry growth.

-

International Expansion – Titan’s efforts to expand globally, especially in markets with high Indian diaspora presence, can drive long-term revenue growth.

-

Digital Transformation & E-commerce – Increased online sales through Titan’s digital platforms and third-party marketplaces can enhance customer reach and sales.

-

Product Innovation & Diversification – Investments in smartwatches, eyewear, and luxury accessories will help Titan stay competitive and attract new customers.

-

Sustainability & ESG Initiatives – A focus on responsible sourcing, ethical business practices, and sustainability can strengthen Titan’s brand image and attract ESG-focused investors, positively impacting its stock value by 2030.

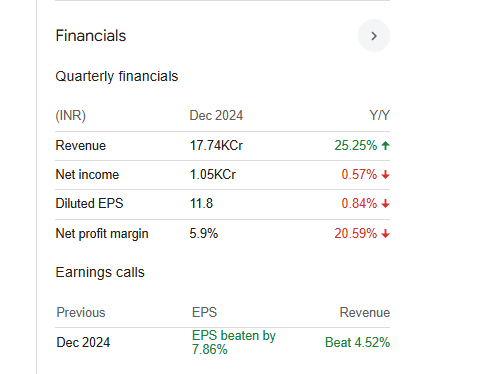

Financials Statement Of Titan

| (INR) | 2024 | Y/Y change |

| Revenue | 510.84B | 25.90% |

| Operating expense | 68.83B | 20.02% |

| Net income | 34.96B | 7.57% |

| Net profit margin | 6.84 | -14.61% |

| Earnings per share | 39.38 | 7.57% |

| EBITDA | 49.45B | 7.36% |

| Effective tax rate | 24.38% | — |

Read Also:- Ambuja Cement Share Price Target Tomorrow 2025, 2026 To 2030