VA Tech Wabag is a well-known name in the water treatment and wastewater management industry. The company is focused on providing sustainable and innovative solutions to help solve global water challenges. With growing demand for clean water and strong government support for green technologies, many investors are showing interest in Wabag’s future growth. Va Tech Wabag Share Price on 4 April 2025 is 1,389.00 INR. This article will provide more details on Va Tech Wabag Share Price Target 2025, 2026 to 2030.

Va Tech Wabag Company Info

- CEO: Rajiv Mittal (Sept 2000–)

- Founded: 1924

- Founder: Max Reder

- Headquarters: Chennai, Vienna, Austria

- Number of employees: 1,600 (2024)

- Revenue: 2,560 crores INR (US$320 million, 2020)

- Subsidiaries: Ghaziabad Water Solutions Private Limited.

Va Tech Wabag Share Price Chart

Va Tech Wabag Share Price Details

- Today Open: 1,439.80

- Today High: 1,439.80

- Today Low: 1,376.00

- Mkt cap: 8.64KCr

- P/E ratio: 33.85

- Div yield: N/A

- 52-wk high: 1,944.00

- 52-wk low: 765.50

Va Tech Wabag Shareholding Pattern

- Promoters: 19.13%

- Foreign Institutions: 18.86%

- Mutual Funds: 1.47%

- Retails and others: 59.99%

- Domestic Institutions: 0.54%

Va Tech Wabag Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹2000

- 2026 – ₹2400

- 2027 – ₹2800

- 2028 – ₹3200

- 2029 – ₹3600

- 2030 – ₹4000

Va Tech Wabag Share Price Target 2025

Va Tech Wabag share price target 2025 Expected target could be ₹2000. As of April 2025, VA Tech Wabag has shown notable developments in the water technology sector. Here are five key factors that could influence its share price target for 2025:

-

Robust Order Book: The company maintains a strong order book of approximately ₹14,500 crore as of the first half of the fiscal year, with a healthy mix of 59% Engineering, Procurement, and Construction (EPC) projects and 41% Operations and Maintenance (O&M) projects. This substantial backlog provides significant revenue visibility and underpins future growth prospects.

-

Financial Performance: In the third quarter of FY2024-2025, VA Tech Wabag reported a 16.62% year-over-year increase in revenue, reaching ₹825.80 crore. Net profit also rose by 11.61% to ₹70.20 crore during the same period. Consistent financial growth enhances investor confidence and positively impacts the share price.

-

Strategic Partnerships and Acquisitions: The company’s recent acquisition of a 51% stake in Taylormade Enviro Private Limited expands its footprint in the solar thermal sector, contributing to diversification and potential revenue streams. Such strategic moves can bolster market position and influence share price positively.

-

Market Expansion and Project Execution: VA Tech Wabag’s focus on expanding its presence in emerging markets and securing major contracts, such as the repeat order worth USD 49 million, demonstrates its competitive edge and potential for revenue growth. Effective execution of these projects is crucial for maintaining profitability and enhancing shareholder value.

-

Analyst Outlook and Valuation: Analysts have assigned a ‘Buy’ rating to VA Tech Wabag, with target prices indicating potential upside. For instance, YES Securities valued the company based on an FY27 EV/EBIT multiple of 16 times, resulting in a target price of ₹1,750 per share. Such positive assessments can attract investors and drive share price appreciation.

Va Tech Wabag Share Price Target 2030

Va Tech Wabag share price target 2030 Expected target could be ₹4000. Here are 5 key factors that could affect VA Tech Wabag’s share price target by 2030:

-

Global Demand for Water Solutions

As the world faces increasing water scarcity and pollution, the need for advanced water treatment, desalination, and recycling technologies will grow. VA Tech Wabag, with its global footprint in over 30 countries, is well-positioned to meet this rising demand, which can drive strong long-term growth. -

Sustainability and ESG Focus

By 2030, environmental, social, and governance (ESG) standards will play an even bigger role in investment decisions. VA Tech Wabag’s core focus on sustainable water management can make it a preferred stock for ESG-focused funds, positively influencing its valuation. -

Innovation and Technology Leadership

Continued investment in R&D, automation, and digital monitoring technologies (like smart water grids and AI-driven plant management) will enhance operational efficiency and keep the company ahead of the curve in a competitive industry. -

Long-Term Contracts and Recurring Revenue

A significant portion of Wabag’s revenue comes from Operations & Maintenance (O&M) contracts, which provide stability and predictability. Expanding these long-term service contracts globally can strengthen recurring income and support share price stability. -

Expansion in Emerging Markets

Urbanization, industrial growth, and stricter environmental laws in regions like Africa, Southeast Asia, and the Middle East will create new market opportunities. Wabag’s early mover advantage in these areas could unlock significant revenue streams by 2030.

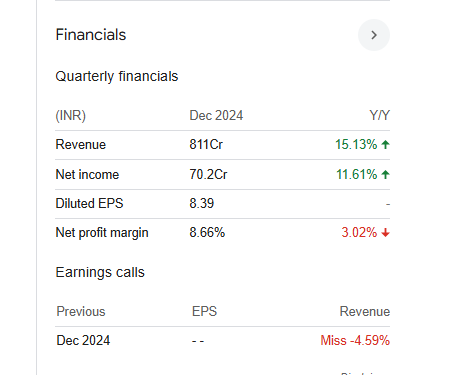

Financial Statement Of Va Tech Wabag

| (INR) | 2024 | Y/Y change |

| Revenue | 28.56B | -3.52% |

| Operating expense | 910.00M | -28.23% |

| Net income | 2.46B | 1,789.23% |

| Net profit margin | 8.60 | 1,854.55% |

| Earnings per share | 39.49 | 7.11% |

| EBITDA | 3.72B | 18.27% |

| Effective tax rate | 24.14% | — |

Read Also:- Taylormade Renewables Share Price Target Tomorrow 2025, 2026 To 2030