Zee Entertainment is one of India’s leading media and entertainment companies, known for its wide range of TV channels, digital content, and movie production. Investors closely follow its share price, as the company plays a key role in the fast-growing entertainment industry. Factors like audience engagement, digital expansion, advertising revenue, and competition impact its stock performance. Zee Entertainment Share Price on 6 March 2025 is 98.18 INR. This article will provide more details on Zee Entertainment Share Price Target 2025, 2026 to 2030.

Zee Entertainment Company Info

- CEO: Punit Goenka (Jul 2008–)

- Founded: 25 November 1982

- Founder: Subhash Chandra

- Headquarters: Mumbai

- Number of employees: 3,065 (2024)

- Parent organization: Essel Corporate Resources Private Limited

- Subsidiaries: Dish TV, Zee Music, Zee Studios

Zee Entertainment Share Price Chart

Zee Entertainment Share Price Details

- Today Open: 99.00

- Today High: 100.98

- Today Low: 98.00

- Mkt cap: 9.43KCr

- P/E ratio: 18.70

- Div yield: 1.02%

- 52-wk high: 168.70

- 52-wk low: 89.32

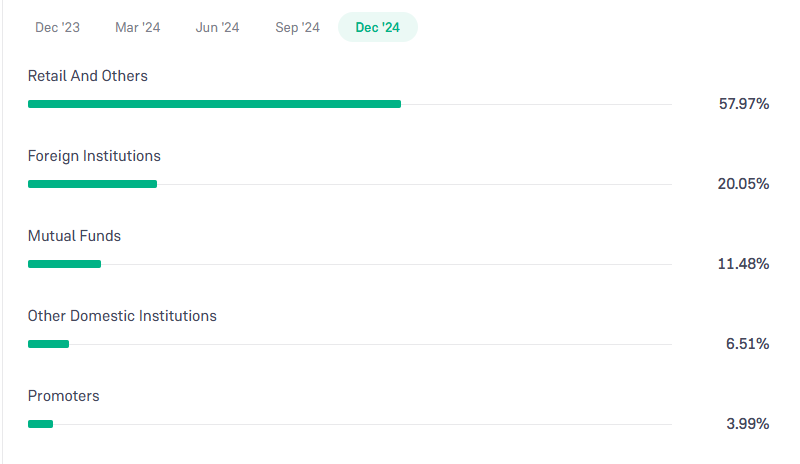

Zee Entertainment Shareholding Pattern

- Promoters: 3.99%

- Foreign Institutions: 20.05%

- Mutual Funds: 11.48%

- Retails and others: 57.97%

- Domestic Institutions: 6.51%

Zee Entertainment Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹170

- 2026 – ₹200

- 2027 – ₹230

- 2028 – ₹260

- 2029 – ₹290

- 2030 – ₹320

Zee Entertainment Share Price Target 2025

Zee Entertainment share price target 2025 Expected target could be ₹170. Here are 5 Key Factors Affecting Growth for Zee Entertainment Share Price Target 2025:

1. Advertising Revenue Growth

Zee Entertainment’s primary source of income comes from advertisements. Higher ad spending by companies, driven by economic growth and increased consumer demand, can boost the company’s revenue and positively impact its share price.

2. Digital and OTT Expansion

The company’s investment in digital streaming platforms like ZEE5 is crucial for future growth. A rise in subscriber base, strong content library, and competitive positioning in the OTT space can drive revenue growth and enhance investor confidence.

3. Content Quality and Audience Engagement

Producing high-quality content that attracts a larger audience is essential for Zee’s success. Popular TV shows, movies, and digital content help in maintaining high TRP ratings, increasing advertising revenue, and strengthening market share.

4. Strategic Partnerships and Acquisitions

Collaborations with production houses, digital platforms, or strategic mergers can help Zee expand its reach and revenue streams. If the company successfully executes growth-oriented deals, it can boost investor sentiment.

5. Regulatory and Corporate Governance Factors

Zee Entertainment has faced governance and management issues in the past. Clear leadership, strong corporate governance, and compliance with regulatory norms will play a significant role in restoring investor trust and ensuring long-term growth.

Zee Entertainment Share Price Target 2030

Zee Entertainment share price target 2030 Expected target could be ₹320. Here are 5 Risks and Challenges for Zee Entertainment Share Price Target 2030:

1. Increasing Competition in the Media Industry

The entertainment sector is highly competitive, with strong players like Netflix, Amazon Prime, Disney+ Hotstar, and other TV networks. Zee must continuously innovate to retain market share, or else its revenue growth could slow down.

2. Declining Traditional TV Viewership

With the rise of digital streaming platforms, traditional TV viewership is gradually decreasing. If Zee does not effectively expand its digital presence and adapt to changing audience preferences, it could face revenue losses.

3. Regulatory and Compliance Risks

The media industry is subject to frequent regulatory changes, including content restrictions, broadcasting policies, and advertising regulations. Any unfavorable government policies or legal issues could impact Zee’s operations and financial performance.

4. Financial and Debt Challenges

If Zee Entertainment takes on excessive debt or struggles with financial stability, it could face difficulties in funding new projects and expanding its digital and TV business. Poor financial management may lead to investor concerns.

5. Uncertainty in Corporate Governance

In the past, Zee has faced governance-related challenges, including leadership disputes and shareholder concerns. Any future issues related to management decisions or corporate transparency could negatively impact investor confidence and share price performance.

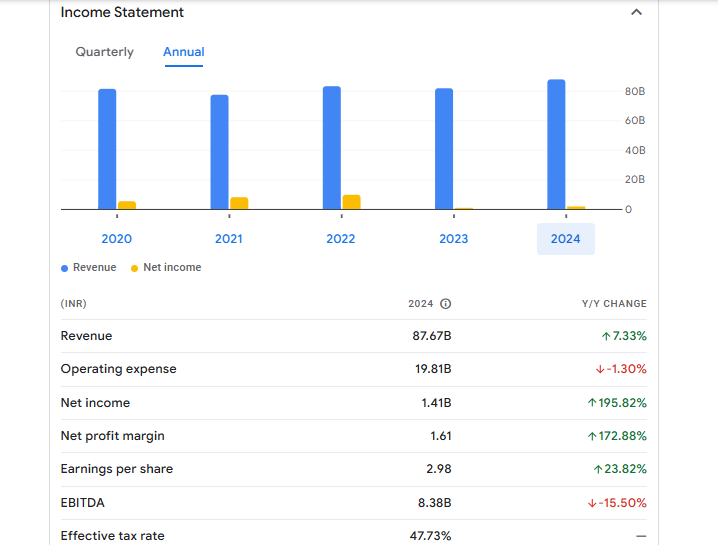

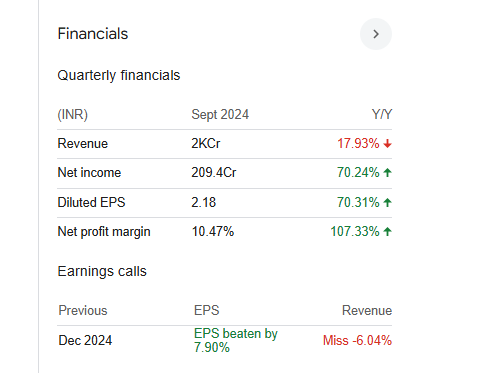

Financials Statement Of Zee Entertainment

| (INR) | 2024 | Y/Y change |

| Revenue | 87.67B | 7.33% |

| Operating expense | 19.81B | -1.30% |

| Net income | 1.41B | 195.82% |

| Net profit margin | 1.61 | 172.88% |

| Earnings per share | 2.98 | 23.82% |

| EBITDA | 8.38B | -15.50% |

| Effective tax rate | 47.73% | — |

Read Also:- HBL Power Share Price Target Tomorrow 2025, 2026 To 2030