Zydus Lifesciences is one of India’s leading pharmaceutical companies, known for making affordable and effective medicines. Over the years, Zydus has built a strong reputation both in India and overseas for its innovation and focus on healthcare. Whether it’s generic medicines or research-based products, the company continues to grow with confidence. Zydus Share Price on 8 April 2025 is 860.00 INR. This article will provide more details on Zydus Share Price Target 2025, 2026 to 2030.

Zydus Company Info

- Founded: 1952

- Founder: Ramanbhai Patel

- Headquarters: Ahmedabad

- Number of employees: 26,921 (2024)

- Parent organization: Zydus Family Trust

- Revenue: 17,273 crores INR (FY23, US$2.2 billion)

- Subsidiaries: Zydus Technologies Limited, Zydus Wellness.

Zydus Share Price Chart

Zydus Share Price Details

- Today Open: 845.00

- Today High: 866.20

- Today Low: 836.10

- Mkt cap: 86.54KCr

- P/E ratio: 19.10

- Div yield: 0.35%

- 52-wk high: 1,324.30

- 52-wk low: 795.00

Zydus Shareholding Pattern

- Promoters: 74.98%

- Foreign Institutions: 7.53%

- Mutual Funds: 6.32%

- Retails and others: 6.84%

- Domestic Institutions: 4.34%

Zydus Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹1330

- 2026 – ₹1400

- 2027 – ₹1500

- 2028 – ₹1600

- 2029 – ₹1700

- 2030 – ₹1800

Zydus Share Price Target 2025

Zydus share price target 2025 Expected target could be ₹1330. As of April 2025, Zydus Lifesciences Ltd. is a prominent player in the pharmaceutical industry. Several key factors are influencing the company’s growth and share price target for 2025:

-

Robust Financial Performance

In the third quarter of FY2025, Zydus Lifesciences reported a consolidated net profit of ₹1,023.80 crore, marking a 30% year-over-year increase. This growth was driven by strong demand for its generic drugs, particularly in the U.S. market.

-

Analyst Recommendations and Target Prices

Analysts have set an average target price of ₹1,068.57 for Zydus Lifesciences, with estimates ranging from ₹840.00 to ₹1,365.00. This suggests a potential upside from the current market price.

-

Research and Development Initiatives

The company is investing in innovative treatments, such as Saroglitazar for Primary Biliary Cholangitis (PBC), aiming for a U.S. launch by early 2026. These R&D efforts are expected to enhance its product portfolio and revenue streams.

-

Strategic Acquisitions

Zydus Lifesciences is actively pursuing acquisitions in the rare disease sector, exemplified by its recent acquisition of a drug for Menkes disease. These strategic moves are intended to diversify its offerings and strengthen its market position.

-

Regulatory Approvals and Market Expansion

The company’s receipt of FDA approval for new drugs, including a prostate cancer treatment, enables entry into new therapeutic areas and markets, potentially driving future growth.

Zydus Share Price Target 2030

Zydus share price target 2030 Expected target could be ₹1800. Here are 5 key factors that could influence Zydus Lifesciences’ share price target by 2030:

-

Expansion in Global Markets

Zydus has been actively expanding in the U.S. and Europe through generic launches and biosimilars. By 2030, continued success in regulated markets and tapping into emerging economies will be crucial for sustaining long-term revenue growth. -

Innovation in Specialty and Rare Disease Drugs

Zydus is shifting focus from pure generics to high-value segments like specialty treatments, rare diseases, and NCEs (new chemical entities). Its work on drugs like Saroglitazar and therapies for Menkes disease reflects this shift, which could lead to stronger profit margins and brand leadership by 2030. -

Investment in R&D and Product Pipeline

R&D will be a core driver of Zydus’ long-term value. With increased investment in clinical trials, biosimilars, and novel therapies, a strong pipeline will ensure steady launches that support share price appreciation over the decade. -

Regulatory Approvals and Strategic Partnerships

Frequent U.S. FDA and European EMA approvals, along with co-development and licensing deals, will play a big role. These partnerships can reduce risk, share costs, and accelerate access to new markets and technologies. -

ESG Practices and Sustainability Focus

As global investors increasingly look at ESG (Environmental, Social, Governance) performance, Zydus’ efforts in ethical practices, sustainable operations, and affordable healthcare access could help attract long-term institutional investment, which can lift its valuation.

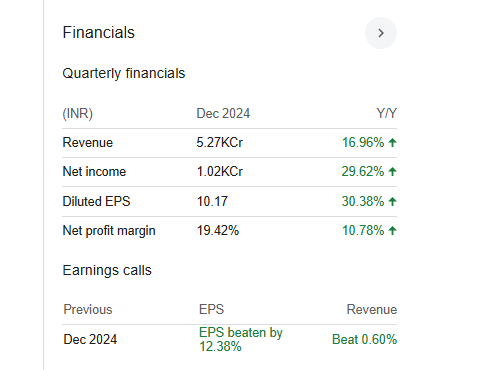

Financial Statement Of Zydus

| (INR) | 2024 | Y/Y change |

| Revenue | 52.69B | 16.96% |

| Operating expense | 27.10B | 26.05% |

| Net income | 10.24B | 29.62% |

| Net profit margin | 19.42 | 10.78% |

| Earnings per share | 10.18 | 34.12% |

| EBITDA | 11.56B | 9.28% |

| Effective tax rate | 14.88% | — |

Read Also:- Om Infra Share Price Target Tomorrow 2025, 2026 To 2030